Most people who know me know that I have loved movies most of my life. One favorite is 2008’s The Dark Knight, where Harvey Dent proclaims hope to a skeptical media, “The night is darkest just before the dawn. And I promise you, the dawn is coming!” This comes to mind as I observe valuations and prospects for oilfield service companies. It has been tough sledding for OFS companies during COVID. Many shuttered their doors, equipment, or people. At the end of 2020, rig counts were around 350 and DUC counts were high.

However, as we’ve been talking about for the past several weeks, things have changed for the positive as far as the industry is concerned, and it’s going to get better according to people like Marshall Adkins of Raymond James, who spoke at the NAPE Global Business Conference in Houston. The current U.S. rig count is now at 613 and, according to Mr. Adkins, may be heading to 800 this year if OFS companies can fill a real labor shortage gap.

However, when it comes to valuations, assuming oilfield service companies will join the recovery has not always been true in the shale era. That said – this time may be different.

What’s Old Is New: Cycle Could Be Pivoting

OFS is well documented to be one of the most cyclical industries. Financial performance tends to lag customers in the E&P sector. As an example, despite the expectation for strong revenue growth in 2022, analysts project that EBITDA margins are expected to actually decline slightly from a year-end 2020 median forecast of 12.8%, to a current figure of 12.2%. However, what if that growth continued beyond 2022 and into the following years? Many think this will be the case as global demand for oil and gas continues to grow amid the surge in renewables. Industry research analysts at IBISWorld project growth of 2.4% compounded for the entire $85.4 billion revenue industry (that’s over $2 billion of revenue growth every year for the next five years). Adkins sees this as the beginning of a multi-year bull run for energy on the tail of sector underinvestment, low supply, inflation, and demand growth rising to pre-COVID levels.

Past Oilfield Service Performance

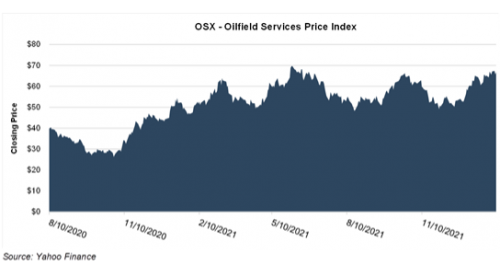

Oilfield service providers, drillers, pumpers, and equipment providers enabled E&P companies to ramp back up. So, where do they stand today? One lens through which to view things is the OSX index–a popular metric to track sector performance.

Since the end of 2020, the OSX index has bounced around but has generally moved back up as demand has risen. In addition, this will almost certainly go higher if rig counts go back up to 800, which hasn’t been the case since 2019. From Adkins’ perspective, his question is: will the OFS industry be able to handle getting back up to 800 rigs? This is particularly acute from a labor perspective. The oilpatch has long been challenged to attract workers because of seasonality, remote operations, camp life, and the expectation that you will continue working regardless of the weather. It compensated with high wages, interesting and challenging work, and endless opportunities for advancement in a growing industry. But that’s not the case in 2022. The young generation that the industry has always managed to attract is increasingly urban, pampered, and has grown up in a society that has a negative impression of fossil fuels and is produced by an industry that some perceive to have no future. All the while the demand grows. Part of the reason for this growing demand is the steady depletion of drilled but uncompleted (DUC) well inventory in the past year or so. DUCs will eventually deplete to the point that more new wells must be drilled, thus increasing demand for OFS. E&P companies will, out of necessity, rediscover great respect for their suppliers. And the service sector will enjoy rewards for surviving the past seven years – perhaps not bigger, but certainly much better.

Current Oilfield Service Performance

Higher oil prices, coupled with competitive breakeven costs for producers, are making drillers, completers and a host of other servicers busy. Capex budgets for E&P companies, known as lead indicators for drillers and contractors, have cautiously been increasing, even amid the capital discipline drumbeat over the past several years.

IHS Markit released a report early this month titled, “The Great Supply Chain Disruption: Why It Continues in 2022.” In the introduction, Vice-Chairman Daniel Yergin wrote, “There is no recent historical precedent for the current disruption in the modern highly integrated global supply chain system that has developed over the last three decades … [resulting in] delays and disruptions for manufacturers and deliveries on a scale never recorded in our 30 years of PMIs (Purchasing Managers’ Index).”

In the meantime, the oil patch will need its supply chain to be working. According to Rystad Energy, the average productivity of new wells in the Permian Basin is set to hit a record high in 2022, breaching past 1,000 BOED due to a surge in lateral well length. The only way that this can be done is with more OFS services.

Valuation Turnaround

Now that utilization rates and day rates are both trending upward, valuations should logically respond and by certain aspects, they are.

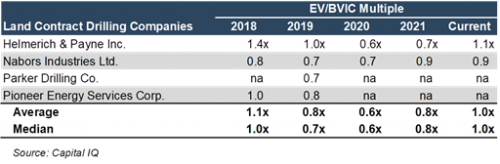

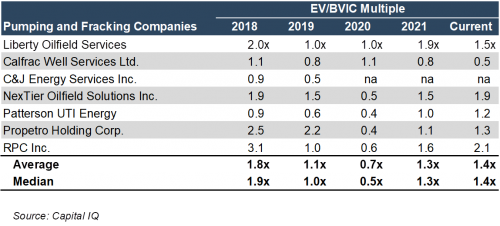

Take, for example, a selection of guideline company groups: onshore drillers and pressure pumpers (fracking companies). One way to observe the degree of relative value changes is to look at enterprise value (sans cash) relative to total book value of net invested capital (debt and equity) held by the company or “BVIC”. Any multiple over 1.0x indicates valuations above what net capital investors have placed into the firm, which for drillers and pumpers is a notable threshold.

In 2019-2020, with a multiple well below 1.0x, investors didn’t expect to get an adequate return on the capital deployed at these companies. However, in 2021 and continuing in early 2022, that trend has reversed. This suggests that the market is recognizing intangible value again for assets such as developed technology, customer relationships, trade names and goodwill. For pressure pumping and fracking concentrated businesses, which are more directly tied to DUCs, the trend is clear. Intangible asset valuations have grown even faster, more heavily weighted towards pumpers’ developed technology that is driving demand for these companies’ services.

Conclusion

Overall rig counts have shifted downward since 2014 and are currently nowhere near levels back then, however, this cycle may resemble pre-shale eras when fundamentals like inflation, supply issues, and related factors pushed commodity prices upward for extended periods. Oil and gas are fundamental economic building blocks in the world economy. If the longer-term cycles are pivoting towards the direction they appear, values of OFS companies may be increasing for a longer cycle this time.