The close of 2021 marked the end of a long upward march for the energy sector. With oil closing up the year at $75 (compared to $48 at the end of 2020) and gas at nearly $4 per mmbtu (compared to $2.36 at the end of 2020), the commodity markets driving the energy sector were much more economically attractive to producers. Stock indices such as the XLE, which primarily tracks the broader energy sector, was up over 50% for 2021 and was by far the best performing sector. Rig counts, although with more cautious deployment than in the past, rose along with prices and increased by 235 for the year (586 at year-end 2021 vs. 351 at year-end 2020). Crude production rose to 11.7 million bbls/day with room to grow as inventories were about 7% below the five-year average. OPEC+ also has signaled it will continue its scheduled output growth.

All of this growth is coming alongside the ascent of wind and solar. The Omicron variant raises uncertainty about the markets and took a cut into prices in December. However, while COVID may dampen demand growth, most analysts believe it won’t stop it.

Prices & Production

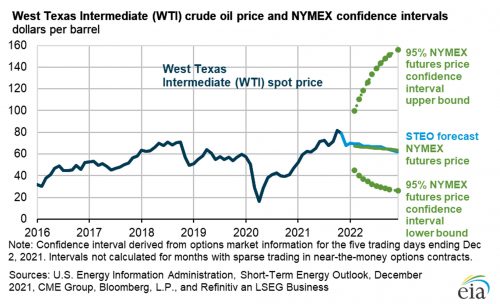

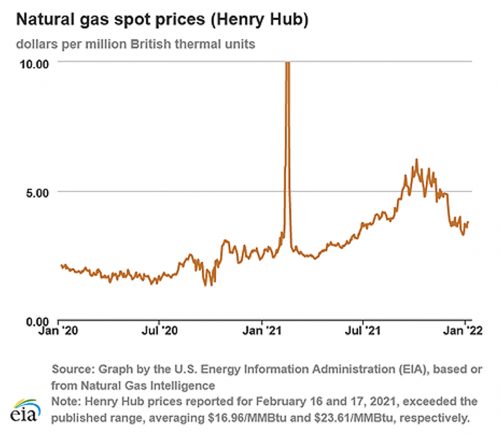

“We expect Brent prices will average $71/b in December and $73/b in the first quarter of 2022 (1Q22). For 2022 as a whole, we expect that growth in production from OPEC+, of U.S. tight oil, and from other non-OPEC countries will outpace slowing growth in global oil consumption, especially in light of renewed concerns about COVID-19 variants. We expect Brent prices will remain near current levels in 2022, averaging $70/b.” – EIA – December 7, 2021 The steady climb of prices in 2021 reflected a rebound in demand that exceeded earlier expectations. It also reflected a more cautious approach to bringing more production online and the curtailed capital environment as well. However, that may not last much longer as more estimates accumulate that suggest capital spending for upstream producers will pick up in 2022. Perhaps even more impactful for upstream producers has been the rise of natural gas prices in 2021 as well. After languishing for so long, prices not only exceeded $3.00 per mmbtu they rose to over $5.00 for a brief period.

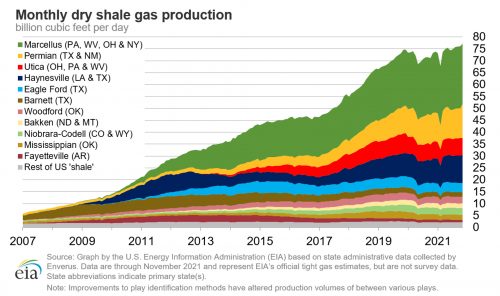

These price levels have been unseen for many years and are anticipated to remain near $4.00 mmbtu in 2022, however, volatility is expected to be higher as well. Production has increased, particularly in Appalachia and has now reached pre-pandemic levels.

Perhaps in 2022 the restraint will come off on production efforts more than the past few years. According to the Dallas Fed Energy Survey 75% of companies surveyed plan to spend more in 2022 vs. 49% in the same survey given at the end of 2020. Cowen & Co. says the E&P companies it tracks plan to spend 13% more in 2022 vs. 2021 after significant drops of 48% in 2020 and 12% in 2019. Much of this growth vigor is fueled by smaller E&P companies that have struggled so much in recent years. However, there is still a lot of uncertainty with inflation and other issues which are keeping larger companies more conservative with their capital as reflected in comments like this: “Supply-chain issues continue to create logistical challenges, and it is difficult to plan and/or coordinate upstream operational activity. Labor shortages have contributed to this issue as well. Pandemic worries are definitely impacting the oil demand side, with resultant uncertainty with respect to commodity pricing and supply forecasting.” – Dallas Fed Respondent For larger companies, debt reduction and quality asset acquisitions are a higher priority as opposed to riding the drill bit.

LNG Delays - But Rest Assured, It Is Coming

One of the outlets for production growth has been the development of LNG facilities along the Gulf Coast. At the end of 2020, there were five (5) facilities under construction. Unfortunately, as of the end of 2021, only one of those terminals got finished. There are still four (4) terminals under construction and no other approved terminals (there are 13 of those) have gotten going as well. This has inhibited production growth for natural gas as LNG is a major global demand growth outlet for U.S. production. The pandemic has delayed bringing online over eight (8) Bcfd of processing capacity. The Biden administration has also not made it any easier either. However, more should come online in 2022 which should help continue the growth trend for gas in the U.S.

Regulatory Prognostications

Speaking of the Biden administration, last year around the election we were discussing some potential policy and impacts of a Biden administration. Several of those potentials have come to pass such as permit rejections, the stoppage of the Dakota Access Pipeline, and a decline in drilling on federal lands.

One thing that has not borne out is the projection by some of a decline in oil production of as much as two million b/d by 2025. Production has held strong so far as prices increased in 2021. Considering the volatility in both regulation and markets, that’s pretty good in the prediction department.