Equity-based compensation has been a key part of compensation plans for years. When the equity compensation involves a publicly traded company, the current value of the stock is known and so the valuation of share-based payments is relatively straightforward. However, for private companies, the valuation of the enterprise and associated share-based compensation can be quite complex.

The AICPA Accounting & Valuation Guide, Valuation of Privately-Held-Company Equity Securities Issued as Compensation, describes four criteria that should be considered when selecting a method for valuing equity securities:

- Going Concern. The method should align with the going-concern status of the company, including expectations about future events and the timing of cash flows. For example, if acquisition of the company is imminent, then expectations regarding the future of the enterprise as a going concern are not particularly relevant.

- Common Share Value. The method should assign some value to the common shares, unless the company is in liquidation with no expected distributions to common shareholders.

- Independent Replication. It is important that the results of the method used by a valuation specialist can be independently replicated or approximated using the same underlying data and assumptions. When completing the valuation, proprietary practices and models should not be the primary method of determining value.

- Complexity and Stage of Development. The complexity of the method selected should be appropriate to the company’s stage of development. In other words, a simpler valuation method (like an OPM) with fewer underlying assumptions may be more appropriate for an early-stage entity with few employees than a highly complex method (like a PWERM).

Current Value Method (CVM)

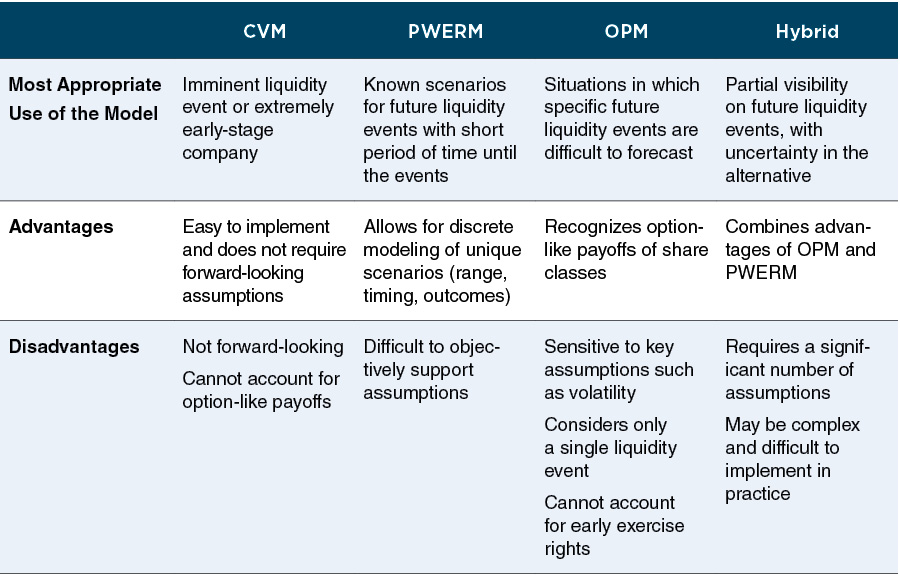

The Current Value Method estimates the total equity value of the company on a controlling basis (assuming an immediate sale) and subtracts the value of the preferred classes based on their liquidation preferences or conversion values. The residual is then allocated to common shareholders. Because the CVM is concerned only with the value of the company on the valuation date, assumptions about future exit events and their timing are not needed. The advantage of this method is that it is easy to implement and does not require a significant number of assumptions or complex modeling.

However, because the CVM is not forward looking and does not consider the option-like payoffs of the share classes, its use is generally limited to two circumstances. First, the CVM could be employed when a liquidity event is imminent (such as a dissolution or an acquisition). The second situation might be when an early-stage company has made no material progress on its business plan, has had no significant common equity value created above the liquidation preference of the preferred shares, and for which no reasonable basis exists to estimate the amount or timing of when such value might be created in the future.

Generally speaking, once a company has raised an arm’s-length financing round (such as venture capital financing), the CVM is no longer an appropriate method.

Probability-Weighted Expected Return Method (PWERM)

The Probability-Weighted Expected Return Method is a multi-step process in which value is estimated based on the probability-weighted present value of various future outcomes. First, the valuation specialist works with management to determine the range of potential future outcomes for the company, such as IPO, sale, dissolution, or continued operation until a later exit date. Next, future equity value under each scenario is estimated and allocated to each share class. Each outcome and its related share values are then weighted based on the probability of the outcome occurring. The value for each share class is discounted back to the valuation date using an appropriate discount rate and divided by the number of shares outstanding in the respective class.

The primary benefit of the PWERM is its ability to directly consider the various terms of shareholder agreements, rights of each class, and the timing when those rights will be exercised. The method allows the valuation specialist to make specific assumptions about the range, timing, and outcomes from specific future events, such as higher or lower values for a strategic sale versus an IPO. The PWERM is most appropriate to use when the period of time between the valuation date and a potential liquidity event is expected to be short.

Of course, the PWERM also has limitations. PWERM models can be difficult to implement because they require detailed assumptions about future exit events and cash flows. Such assumptions may be difficult to support objectively. Further, because it considers only a specific set of outcomes (rather than a full distribution of possible outcomes), the PWERM may not be appropriate for valuing option-like payoffs like profit interests or warrants. In certain cases, analysts may also need to consider interim cash flows or the impact of future rounds of financing.

Option Pricing Model (OPM)

The Option Pricing Model treats each class of shares as call options on the total equity value of the company, with exercise prices based on the liquidation preferences of the preferred stock. Under this method, common shares would have material value only to the extent that residual equity value remains after satisfaction of the preferred stock’s liquidation preference at the time of a liquidity event. The OPM typically uses the Black-Scholes Option Pricing Model to price the various call options.

In contrast to the PWERM, the OPM begins with the current total equity value of the company and estimates the future distribution of outcomes using a lognormal distribution around that current value. This means that two of the critical inputs to the OPM are the current value of the firm and a volatility assumption. Current value of the firm might be estimated with a discounted cash flow method or market methods (for later-stage firms) or inferred from a recent financing transaction using the backsolve method (for early-stage firms). The volatility assumption is usually based upon the observed volatilities of comparable public companies, with potential adjustment for the subject entity’s financial leverage.

The OPM is most appropriate for situations in which specific future liquidity events are difficult to forecast. It can accommodate various terms of stockholder agreements that affect the distributions to each class of equity upon a liquidity event, such as conversion ratios, cash allocations, and dividend policy. Further, the OPM considers these factors as of the future liquidity date, rather than as of the valuation date.

The primary limitations of the OPM are its assumption that future outcomes can be modeled using a lognormal distribution and its reliance on (and sensitivity to) key assumptions like assumed volatility. The OPM also does not explicitly allow for dilution caused by additional financings or the issuance of options or warrants. The OPM can only consider a single liquidity event. As such, the method does not readily accommodate the right or ability of preferred shareholders to early-exercise (which would limit the upside for common shareholders). The potential for early-exercise might be better captured with a lattice or simulation model. For an in-depth discussion on the OPM, see our whitepaper A Layperson’s Guide to the Option Pricing Model at mer.cr/2azLnB.

Hybrid Method

The Hybrid Method is a combination of the PWERM and the OPM. It uses probability-weighted scenarios, but with an OPM to allocate value in one or more of the scenarios.

The Hybrid Method might be employed when a company has visibility regarding a particular exit path (such as a strategic sale) but uncertainties remain if that scenario falls through. In this case, a PWERM might be used to estimate the value of the shares under the strategic sale scenario, along with a probability assumption that the sale goes through. For the scenario in which the transaction does not happen, an OPM would be used to estimate the value of the shares assuming a more uncertain liquidity event at some point in the future.

The primary advantage of the Hybrid Method is that it allows for consideration of discrete future liquidity scenarios while also capturing the option-like payoffs of the various share classes. However, this method typically requires a large number of assumptions and can be difficult to implement in practice.

Conclusion

The methods for valuing private company equity-based compensation range from simplistic (like the CVM) to complex (like the Hybrid Method). In addition to the factors discussed above, the facts and circumstances of a particular company’s stage of development and capital structure can influence the complexity of the valuation method selected. In certain instances, a recent financing round or secondary sale of stock becomes a datapoint that needs to be reconciled to the current valuation analysis and may even prove to be indicative of the value for a particular security in the capital stack (see “Calibrating or Reconciling Valuation Models to Transactions in a Company’s Equity” on page 6). At Mercer Capital, we recommend a conversation early in the process between company management, the company’s auditors, and the valuation specialist to discuss these issues and select an appropriate methodology.

Originally published in the Financial Reporting Update: Equity Compensation, June 2019.