On December 7, 2020, publicly traded SEACOR Holdings announced that it had entered into an agreement with American Industrial Partners (AIP) to go private. The cash transaction, estimated to be worth slightly over $1 billion, is expected to close during the first quarter of 2021. Other transportation companies in AIP’s portfolio include EnTrans International, LLC (bulk and energy transportation) and Rand Logistics (bulk freight shipping).

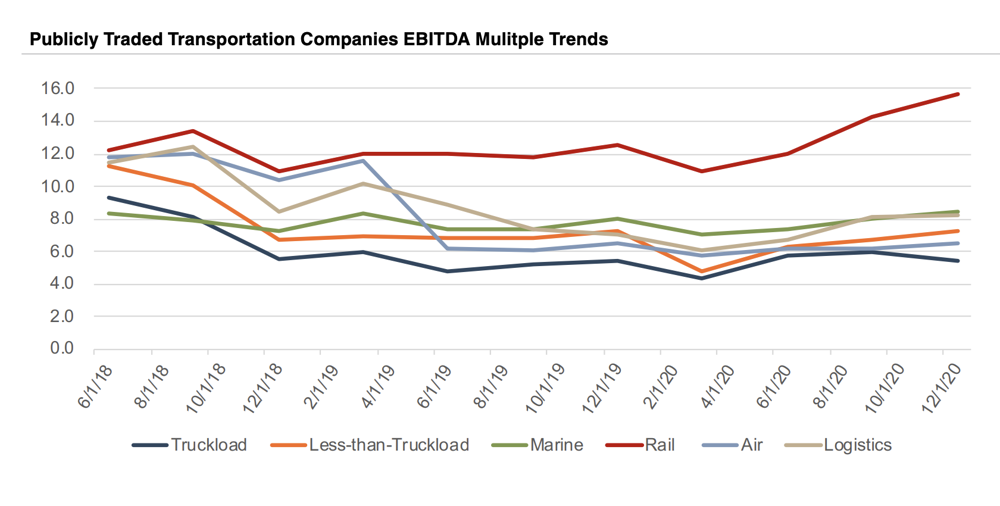

What is particularly notable about the SEACOR transaction is the premium AIP is paying for the company. The purchase price of $41.50 per share is a premium of 14% relative to the December 4, 2020 trading price and reflects a premium of 31% over the 90-day volume-weighted average share price. The transaction also implies revenue and EBITDA multiples of 1.5x and 11.3x, respectively. For perspective, on December 31, 2020, the median enterprise value multiple for marinebased companies was 8.5x EBITDA and the median logistics company multiple was 8.3x. This indicates that AIP paid a significant control premium for SEACOR, possibly reflecting the additional value AIP will get from a strategic relationship with SEACOR.

As shown in the chart, most segments of the transportation industry have experienced a decline in enterprise value to EBITDA multiples relative to 2018. The only segment that has experienced significant expansion in EBITDA multiples has been railroad companies. While no single transaction sets the market for all, transaction activity trends can provide important insight regarding valuation.

Whether it is two trucking lines merging to take advantage of complementary lanes, or a privately held company installing an ESOP, or simply getting an offer that may just be too good to refuse from private equity, it’s important to keep in mind recent market trends and what they mean for the value of your company.

Originally published in Mercer Capital's Transportation & Logistics Newsletter: Third Quarter 2020