Supply chain bottlenecks are causing companies to switch their cargo transportation from rail to truck. According to research conducted by JLL Inc, aggregate demand for goods is still 15% above its levels in the fourth quarter of 2019, just before the pandemic lockdowns began. Suppliers have drastically increased the volume of their output in response to this demand, which, along with other issues, has clogged supply chains. Challenges in retaining drivers and acquiring new trucks and trailers have exacerbated this problem. One of the results of the tangled supply chains has been the shift from rail to road transportation.

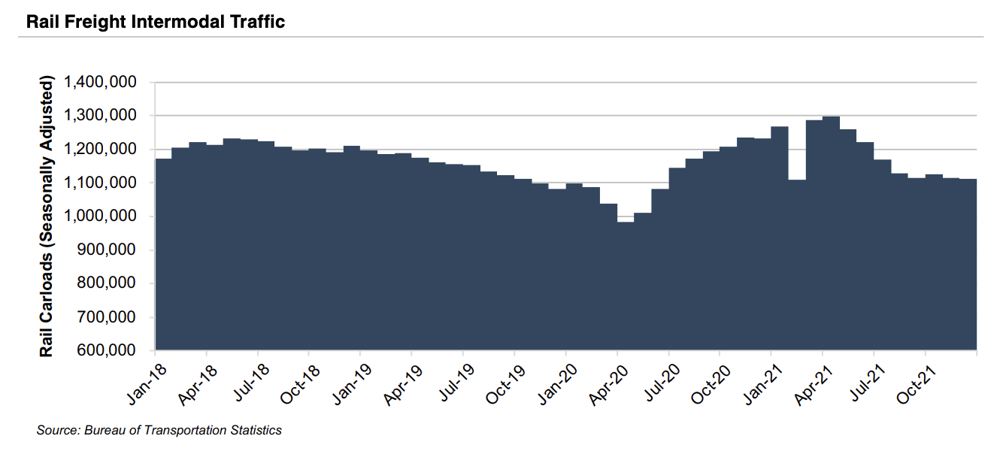

From the fourth quarter of 2020 through the second quarter of 2021, railroads carried record levels of intermodal cargo. This was due in large part to a massive surge of cargo volumes that began a few months after the COVID 19 pandemic. Imports rose 14% in 2021 relative to 2020. The shift towards trucking began early in the pandemic when port facilities found themselves shorthanded, resulting in long wait times to unload ships and move containers out of the ship yards. By December 2021, over 100 ships were waiting to enter the ports of Las Angeles and Long Beach. The backlog continued inland, where an influx of intermodal containers into Chicago congested supply chains. Chicago is a critical hub for moving cargo east of the Mississippi River and is within a 500 mile driving distance of approximately one-third of the US population. The increased number of containers combined with staffing shortages has meant that warehouses and drayage firms have been unable to move all of the containers. Schneider International estimates that unloading containers has been taking 30% longer than in pre-pandemic times.

Railroads responded to the jam by restricting cargo, which then forced shippers to utilize trucking to meet demand. Driver and tractor shortages mentioned previously have contributed to increased road freight prices. While road freight prices are higher than rail freight prices, the speed of trucking compared to rail has led to a change in preferences for many suppliers. For shippers, railroad shipping simply had too many unpredictable delays to make it appealing compared to trucking.

Despite the current trend towards truck shipping, it is likely that railroad shipping companies will recover. A senior vice president for policy and economics at the Association of American Railroads has stated in an interview with the Wall Street Journal that he believes freight railroads could comfortably handle as much as 30,000 more intermodal loads per week than current levels.

In the longer term, it is also very possible that shippers will move back towards intermodal transport for its cost advantages over long-haul trucking despite intermodal’s slower speed overall. It is certainly possible to see the current supply chain environment as a reflection of the uniquely high level of demand during the pandemic. Under these circumstances, speed and certainty are priorities as opposed to cost efficiency. As economic conditions continue to return to normal, it seems likely that shipping firms will once again turn their focus towards minimizing costs rather than meeting as much demand as possible.

Originally published in Mercer Capital's Transportation & Logistics Newsletter: Fourth Quarter 2021