Most experts agree that rates and demand for transportation services have been trending downward. There has been more disagreement about what that means, though – are we headed for a trucking recession, or are we simply coming down off our COVID-19 induced highs?

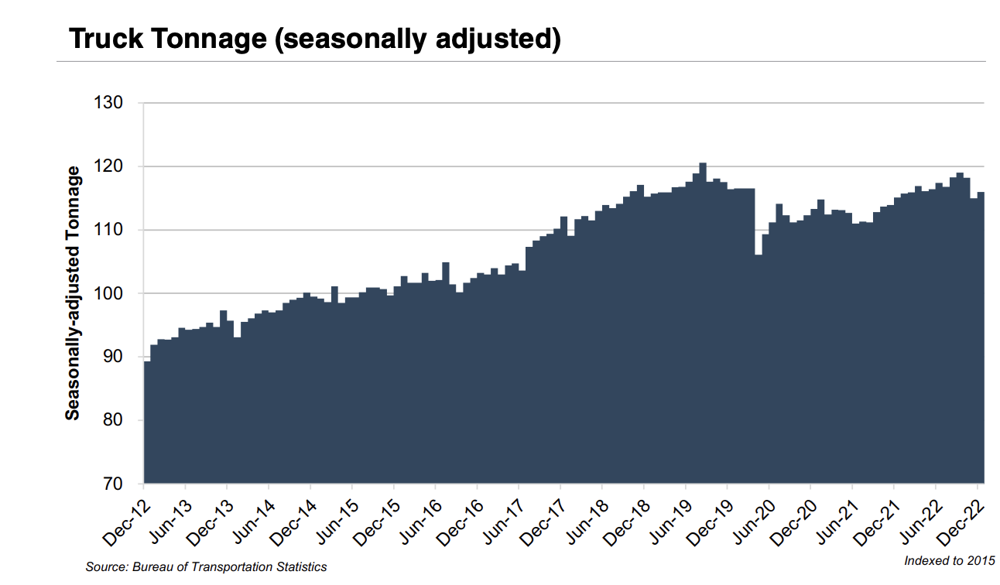

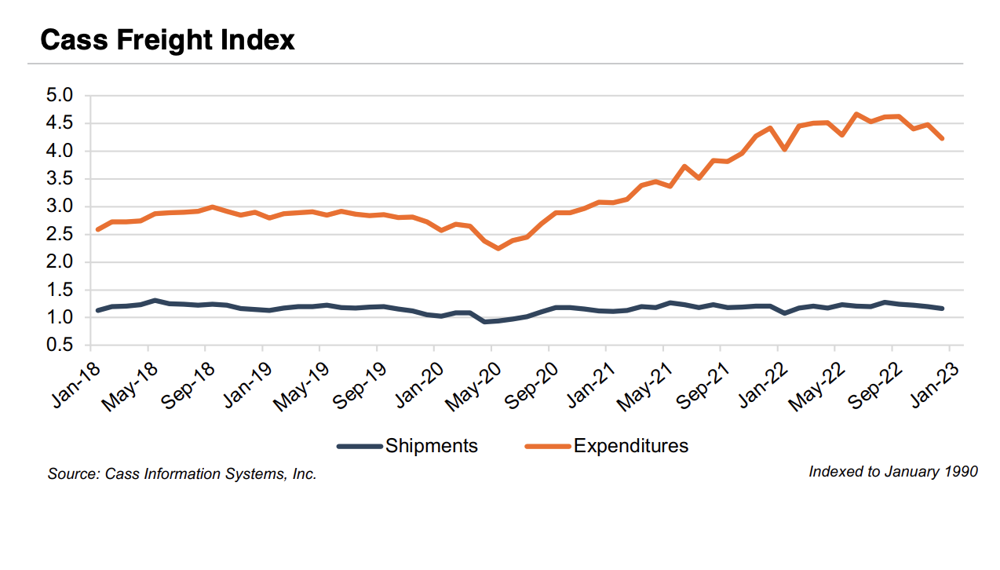

First, let’s set the scene: December 2019 marked the end of an okay-but-not-great year for the transportation industry. Industrial production and the Transportation Services Index both stalled during the fourth quarter of 2019. The Cass Freight Shipments Index had marked three consecutive months of declines and the Expenditures Index had slid all year to end 2019 some 6% below its 2018 levels. While the truck tonnage index increased 1.0% on a year-over-year basis in 2019, tonnage had declined almost 3.5% from its peak in August 2019. Freight volumes were not expected to recover materially during 2020.

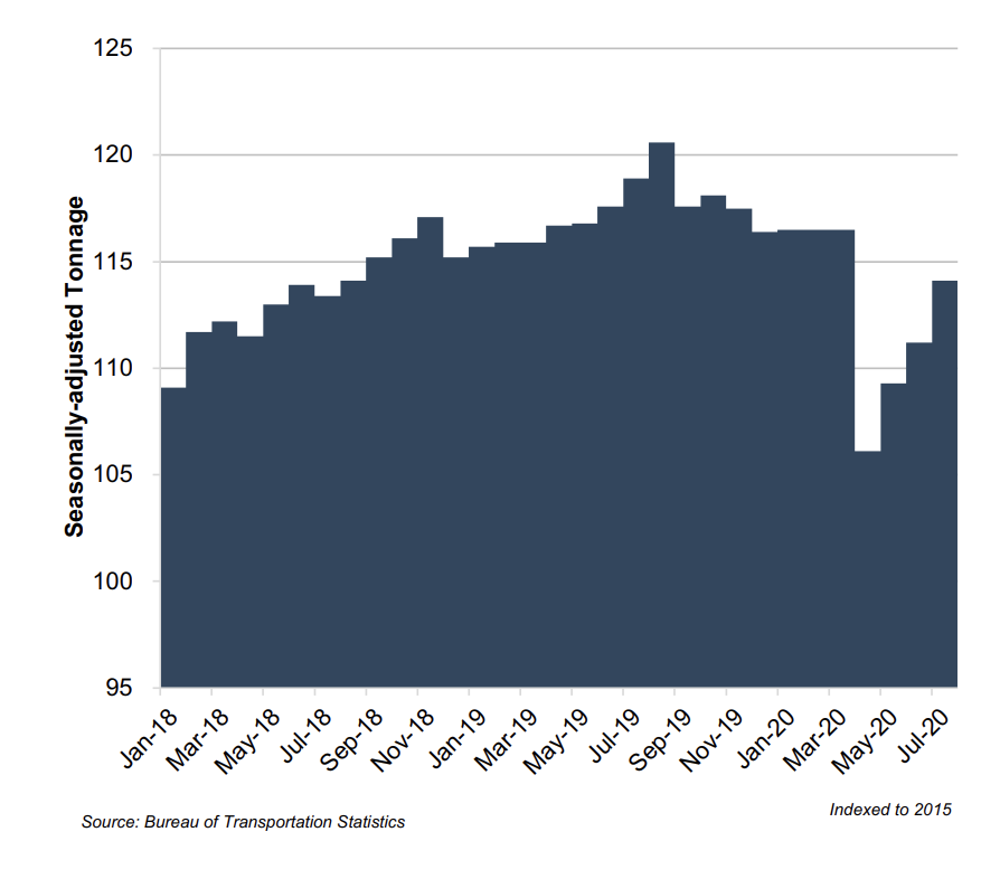

However, to say that 2020 was a series of unexpected non-recurring events would be putting it lightly (whatever did happen to the murder hornets?). The outbreak of the global COVID-19 pandemic and its associated lock downs resulted in plummeting production and demand. Truck tonnage fell 9% and rail carloads dropped by over 5% between March and April 2020. Rates for all three classes of truck transportation reacted to the sudden drop in demand.

A pictorial impact of COVID outbreaks:

Truck Tonnage (seasonally adjusted)

Rail Freight Intermodal Traffic

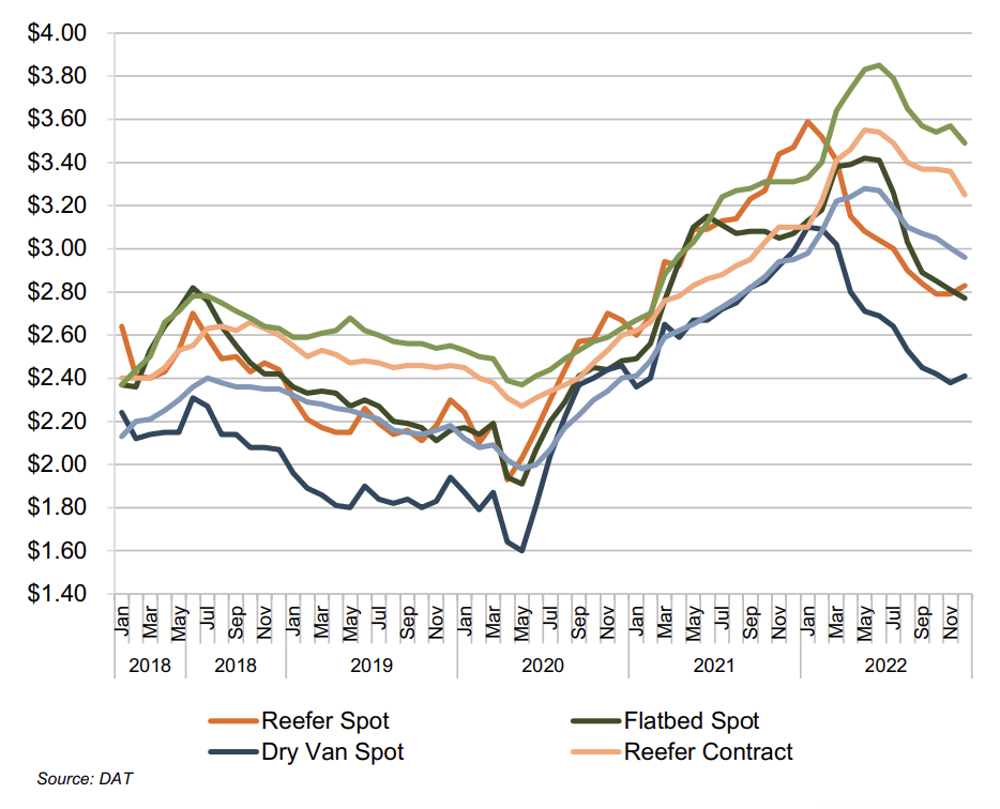

Spot vs. Contract Rates (Jun. 2018 - Dec. 2022)

Even though the industry appeared to have driven off a cliff in March 2020, the crash was short in nature. Ongoing pandemic-related shutdowns shifted consumer demand away from services and towards goods. At the same time, global production and supply chain issues resulted in shortages of semiconductors and microchips, which slowed the production of tractors. The reduction in new tractors reaching the market drove up the prices for used tractors and limited carriers’ abilities to respond to market demands. Additionally, back-ups at marine ports cascaded into a shortage of intermodal containers. The surge in demand, accompanied by limits on capacity growth and ever-present driver turnover issues allowed the industry to throttle up to never-before-experienced levels. The following two charts show how dry van spot and contract rates took off in mid-2020 (red line) and continued to climb through 2021 (blue line).

Now, nearly two years after the initial lock downs, we are seeing several signs of a cooling trucking industry. As you can see in the previous two charts, 2022 dray van rates (tan line) ended the year lower than they started. Spot rates, which tend to move more quickly in response to the market, actually reached rates last seen in the fourth quarter of 2020. The decline in rates was accompanied by moderating levels of truck tonnage and a downturn of the Cass freight expenditures index.

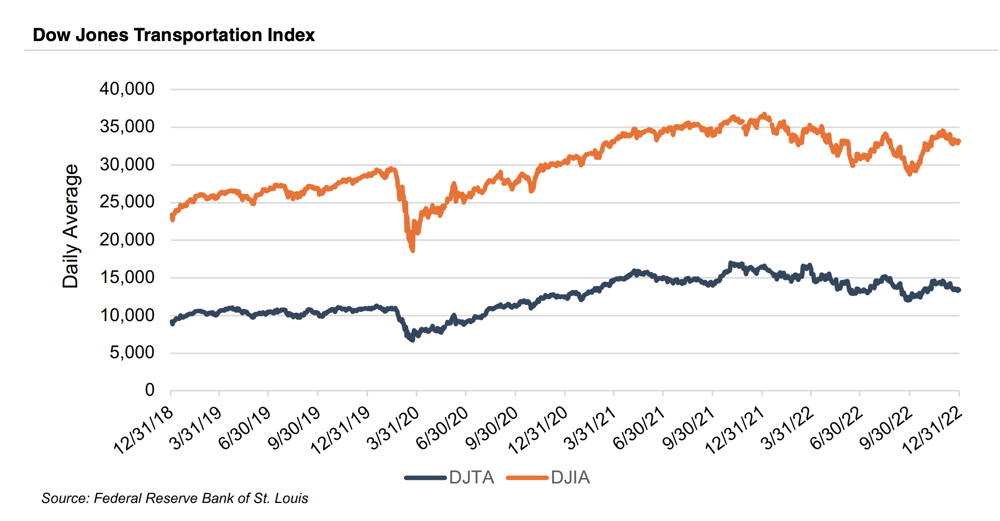

While declining tonnage and falling rates are typically associated with recessionary trends, it’s important to remember exactly how high industry indicators reached during the pandemic period. Even though dry van contract rates are down 10% from their May 2022 peak, the average 2022 dry van contract rate ($3.12) remains over 40% higher than the average 2019 rate ($2.22) and 35% higher than the average 2018 rate ($2.30). On the spot rate side of things, even though rates in December 2022 ended below December 2020 rates, the average 2022 spot rate is 45% higher than the average 2019 rate and 35% higher than the average 2018 rate. Likewise, even though the Dow Jones Transportation Average (chart on next page) is down nearly 19% on a year-over-year basis, it remains nearly 23% higher than the closing value in December 2019. By comparison, the entire Dow Jones Industrial declined almost 9% since December 2021 and increased 16% relative to December 2019.

At the end of the day, when emerging from a period of highly unusual circumstances, it’s important to look beyond shortterm trends. While rate declines and falling tonnage would be a concern on a normal basis, the fact remains that the transportation industry as a whole experienced an era of unprecedented demand and pricing during the pandemic. We all knew it couldn’t last forever and a return to “normal” would come eventually. While it may have arrived a bit more abruptly than we previously expected (or hoped!), it’s hard to consider the industry in a recession when it remains so elevated compared to pre-pandemic norms.

Originally published in Mercer Capital's Transportation & Logistics Newsletter: Fourth Quarter 2022