The Rise of Robo-Advisors

Part 1

Despite the potential for FinTech innovation within wealth management, significant uncertainty still exists regarding whether these innovations will displace traditional wealth management business models. In this two part blogpost, excerpted from colleague, Jay Wilson’s, new book on FinTech forthcoming from Wiley in early 2017, we look at the potential of Robo-Advisors and offer some thoughts on valuation.

Robo-advisory has the potential to significantly impact traditional wealth management. It represents a FinTech niche that is similar to the transition from full-service traditional brokers to discount online brokers. Robo-advisors were noted by the CFA Institute as the FinTech innovation most likely to have the greatest impact on the financial services industry in the short-term (one year) and medium-term (five years). Robo-advisory has gained traction in the past several years as a niche within the FinTech industry offering online wealth management tools powered by sophisticated algorithms that can help investors manage their portfolios at low costs and with minimal need for human contact or advice. Technological advances making this business model possible, coupled with a loss of consumer trust in the wealth management industry in the wake of the financial crisis, have created a favorable environment for the growth of robo-advisory startups meant to disrupt financial advisories, RIAs, and wealth managers. This growth is forcing traditional incumbents to explore their treatment of the robo-advisory model in an effort to determine their response to the disruption of the industry.

While there are a number of reasons for the success of robo-advisors attracting and retaining clients thus far, we highlight a few primary reasons.

- Low Cost. Automated, algorithm-driven decision-making greatly lowers the cost of financial advice and portfolio management.

- Accessible. As a result of the lowered cost of financial advice, advanced investment strategies are more accessible to a wider customer base.

- Personalized Strategies. Sophisticated algorithms and computer systems create personalized investment strategies that are highly tailored to the specific needs of individual investors.

- Transparent. Through online platforms and mobile apps, clients are able to view information about their portfolios and enjoy visibility in regard to the way their money in being managed.

- Convenient. Portfolio information and management becomes available on-demand through online platforms and mobile apps.

Consistent with the rise in consumer demand for robo-advisory, investor interest has grown steadily. While robo-advisory has not drawn the levels of investment seen in other niches (such as online lending platforms), venture capital funding of robo-advisories has skyrocketed from almost non-existent levels ten years ago to hundreds of millions of dollars invested annually the last few years. 2016 saw several notable rounds of investment into not only some of the industry’s largest and most mature players (including rounds of $100 million for Betterment and $75 million for Personal Capital), but also for innovative startups just getting off the ground (such as SigFig and Vestmark).

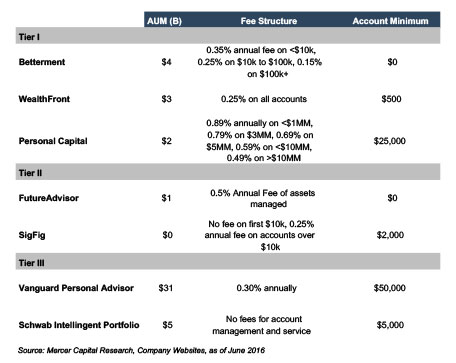

The exhibit below provides an overview of the fee schedules, assets under management and account opening minimums for several of the larger robo-advisors. The robo-advisors are separated into three tiers. Tier I consists of early robo-advisory firms who have positioned themselves at the top of the industry. Tier II consists of more recent robo-advisory startups that are experiencing rapid growth and are ripe for partnership. Tier III consists of robo-advisory services of traditional players who have decided to build and run their own technology in-house. As shown, account opening sizes and fee schedules are lower than many traditional wealth management firms. The strategic challenge for a number of the FinTech startups in Tiers 1 and II is generating enough AUM and scale to produce revenue sufficient to maintain the significantly lower fee schedules. This can be challenging since the cost to acquire a new customer can be significant and each of these startups has required significant venture capital funding to develop. For example, each of these companies has raised over $100 million of venture capital funding since inception.

Key Potential Effects of Robo-Advisory

We see four potential effects of robo-advisors entering the financial services landscape.

- The Democratization of Wealth Management. As a result of the low costs of robo-advisory services, new investors have been able to gain access to sophisticated investment strategies that, in the past, have only been available to high net worth, accredited investors.

- Holistic Financial Life Management. As more people have access to financial advice through robo-advisors, traditional financial advisors are being forced to move away from return-driven goals for clients and pivot towards offering a more complete picture of a client’s financial well-being as clients save for milestones such as retirement, a child’s education, and a new house. This phenomenon has increased the differentiation pressure on traditional financial advisors and RIAs, as robo-advisors can offer a holistic snapshot in a manner that is comprehensive and easy to understand

- Drivers of the Changing Role of the Traditional Financial Advisor. The potential shift away from return-driven goals could leave the role of the traditional financial advisor in limbo. This raises the question of what traditional wealth managers will look like going forward. One potential answer is traditional financial advisors will tackle more complex issues, such as tax and estate planning, and leave the more programmed decision-making to robo-advisors.

- Build, Buy, Partner, or Wait and See. As the role of the financial advisor changes, traditional incumbents are faced with determining what they want their relationship with robo-advisory to look like. In short, incumbents are left with four options: build their own robo-advisory in-house, buy a startup and adopt its technology, create a strategic partnership with a startup, or stay in a holding pattern in regard to robo-advisory and continue business as usual. We discuss each option in more depth in the following section.

The debate about the impact of technology on wealth management has moved on to considerations about how best to respond. In the second part of this post, we pick up on this last thought about strategies to capitalize on FinTech in the investment management industry, and include a couple of case studies for how it has been done.

RIA Valuation Insights

RIA Valuation Insights