Q1 2021 M&A Update

An RIA M&A Frenzy

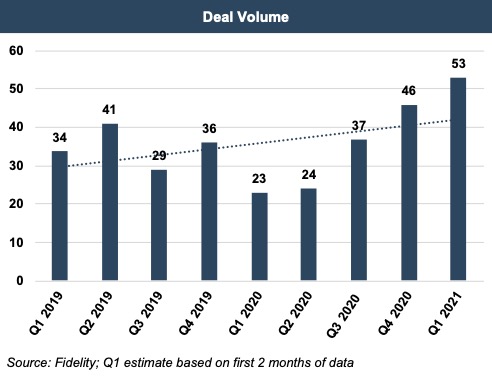

Despite the hiatus in M&A beginning with the onset of COVID-19, 2020 was a strong year for RIA mergers and acquisitions, and 2021 is expected to be even stronger.

Many of the same forces that have spurred M&A over the last five years drove deal activity in late 2020 and early 2021. Fee pressure in the asset management space and a lack of succession planning by wealth managers are still driving consolidation. But the increased availability of funding in the space, in tandem with more lenient financing terms, has also caused some of this uptick.

There has been growing interest over the last few years from private equity and permanent capital providers who find investment managers’ recurring revenue streams and availability for operating leverage attractive. Investors, hungry for alpha in a low-yield environment, are driving up deal prices leading more firms to hang up a for-sale sign.

Additionally, deal activity was bolstered by the low cost of credit and lenient financing terms by historical standards. As Jeff Davis, our bank guru, explains;

“Loans in the commercial banking system declined for the first time in a decade in 2020 and for only the second time in 28 years while deposits remain historically high. In the current low-rate environment, revenue pressures are high for banks as cash and bonds yield little to nothing. Without a competitive alternative, banks and investors flush with capital are under pressure to compete for lending opportunities to produce a return while loan demand is weak as the U.S. market rounds what many believe to be the very beginnings of a new economic cycle.”

There is a growing number of banks interested in lending to the space. Live Oak Bank pioneered an SBA vertical in lending to RIAs and investment advisor Oak Street Funding has played a role in a substantial portion of leveraged transactions in this space, and most recently SkyView began offering financing solutions for RIAs.

Further, the Biden administration’s efforts to increase the capital gains tax rate may also accelerate some M&A activity in the immediate short-term as sellers seek to position transactions to be taxed at current tax rates.

What Does This Mean for Your RIA?

If you are planning to grow through strategic acquisitions, the price may be higher, and the deal terms will likely favor the seller, leaving you more exposed to underperformance. In a market this competitive, acquirers need to distinguish themselves on more than price. Sellers are often looking for buyers who can help them achieve scale, reduce the load of managing a business, and/or expand their reach or distribution capability.

If you are considering an internal transition, know there are more ways to finance the buy-out than there used to be. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and in some instances may still be the best option), but bank financing can provide the founding generation with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

If you are an RIA considering selling, there are many options, and it is important to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. A strategic buyer will likely be interested in acquiring a controlling position in your firm with some form of contingent consideration to incentivize the selling owners to transition the business smoothly after closing. Alternatively, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference.

RIA Valuation Insights

RIA Valuation Insights