5 Things to Know About the SEC’s New Pay Versus Performance Rules

In August 2022, the SEC adopted final rules implementing the Pay Versus Performance Disclosure required by Section 953(a) of the Dodd-Frank Act. These rules go into effect for the 2023 proxy season and introduce significant new valuation requirements related to equity-based compensation paid to company executives. What does this mean, and how does it apply to you? What are the requirements, and why might there be significant valuation challenges involved? We discuss all that and more below.

Executive Summary

- The new SEC proxy disclosure rules introduce several new requirements, including that registrants calculate and disclose a new figure (Compensation Actually Paid), alongside existing executive compensation information. For most registrants, the rules will apply to upcoming 2023 proxy season.

- A new Pay Versus Performance table will detail the relationship between the Compensation Actually Paid, the financial performance of the registrant over the time horizon of the disclosure, and comparisons of total shareholder return.

- The newly introduced concept of Compensation Actually Paid will require companies to measure the period-to-period change in the fair value of all equity-based compensation awarded to named executive officers.

- The type of equity awards that have been granted will determine the complexity of the valuation process. Equity-based awards such as stock options might require updated Black Scholes or lattice modeling, while awards with performance or market conditions may require more complex Monte Carlo simulations.

- Registrants should understand that if equity awards have been granted on a consistent basis for a period of years, the new rules could require a large number of historical valuations for this initial proxy season and a significant amount of disclosure complexity.

Advance planning and processes will be needed to establish the scope and complexity of complying with the new rules, including identifying how many equity-based awards will require updated valuations to measure the period-to-period changes.

1. Overview and Background

The new disclosures were mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act and were originally proposed by the SEC in 2015. These rules will add a new item 402(v) to Regulation S-K and are intended to provide investors with more transparent, readily comparable, and understandable disclosure of a registrant’s executive compensation. The new provisions apply to all reporting companies other than (i) foreign private issuers, (ii) registered investment companies, and (iii) emerging growth companies.

The rules apply to any proxy and information statement where shareholders are voting on directors or executive compensation that is filed in respect of a fiscal year ending on or after December 16, 2022. As such, the vast majority of registrants will be required to include related disclosure for their 2023 proxy statements, though there are relaxed requirements for smaller reporting companies.

The new SEC proxy disclosure rules introduce several new requirements, including that registrants calculate and disclose a new figure (Compensation Actually Paid), alongside existing executive compensation information. For most registrants, the rules will apply to upcoming 2023 proxy season.

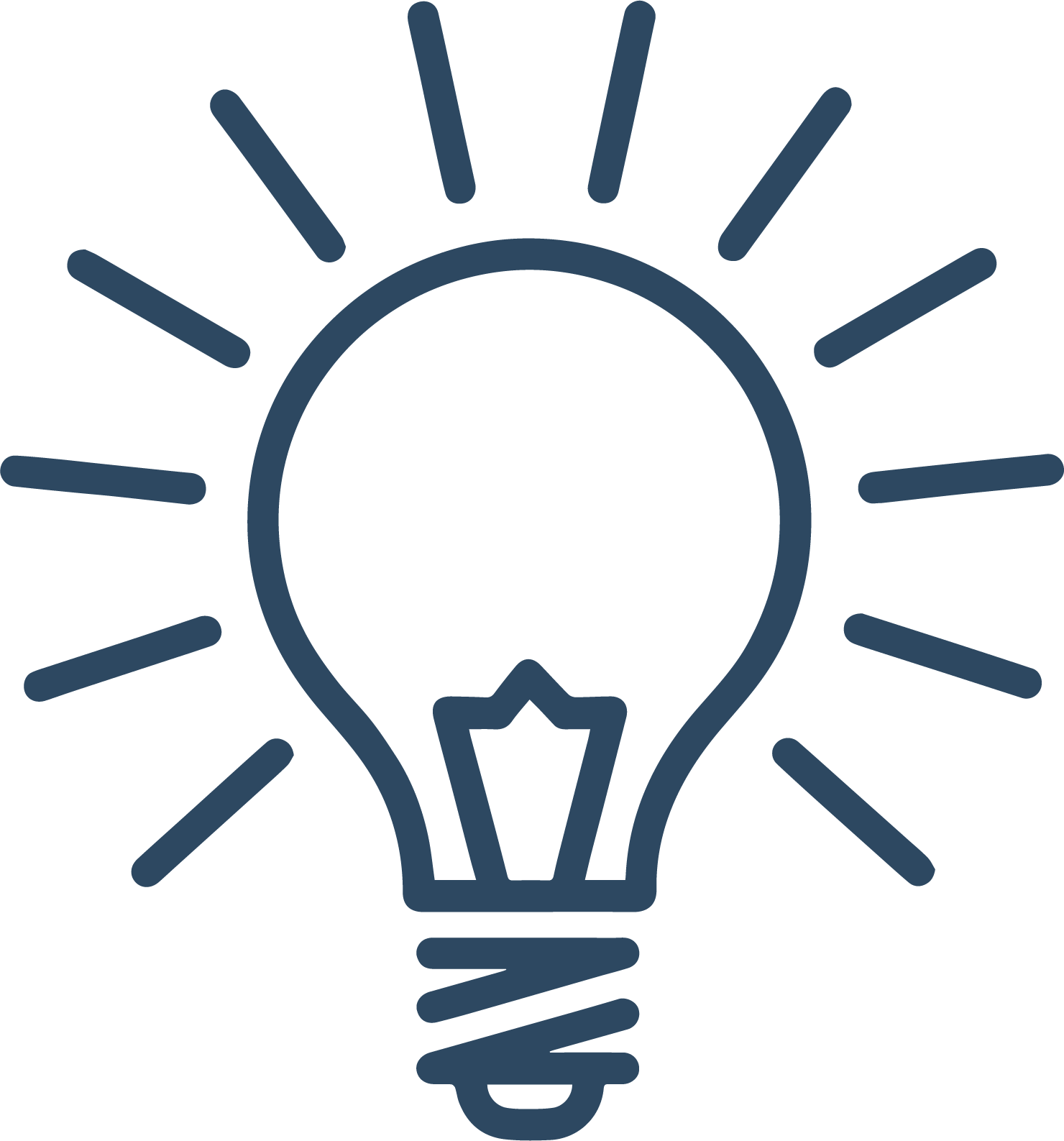

2. The Pay Versus Performance Table

The new rules require registrants to describe the relationship between the Executive Compensation Actually Paid (“CAP”) and the financial performance of the registrant over the time horizon of the disclosure. Additional items include disclosure of the cumulative Total Shareholder Return (“TSR”) of the registrant, the TSR of the registrant’s peer group, the registrant’s net income, and a company-selected measure chosen by the registrant as a measure of financial performance. These items are to be disclosed in tabular form (based on an example included in the final rule), which is replicated below.

Click here to expand the table above

The table includes the following components:

- Year. The form applies to the five most recent fiscal years (or three years for smaller reporting companies)

- Summary Compensation Table Total for Primary Executive Officer (PEO). These are the same total compensation figures as reported under existing SEC proxy disclosure requirements. However, additional columns may need to be added if there was PEO turnover in the relevant periods.

- Compensation Actually Paid to PEO. For each fiscal year, registrants are required to make adjustments to the total PEO compensation reported in Item (b) for pension and equity awards that are calculated in accordance with US GAAP. This item is potentially complex and is discussed in detail below.

- Average Summary Compensation Table Total for Non-PEO Named Executive Officers (NEOs). These average figures would be calculated using the same compensation figures as reported under existing SEC proxy disclosure requirements for NEOs. Different individuals may be included in the average throughout the five (or three) year period. Footnote disclosure is required to list the individual NEOs.

- Average Compensation Actually Paid to Non-PEO NEOs. These amounts would be calculated using the same methodology as in Item (c), but then averaging the amounts in each year.

- Total Shareholder Return. The registrant’s TSR is to be determined in the same manner as is required by existing Regulation S-K guidance. TSR is calculated as the sum of (1) cumulative dividends (assuming dividend reinvestment) and (2) the increase or decrease in the company’s stock price for the year, divided by the share price at the beginning of the year.

- Peer Group Total Shareholder Return. This is calculated consistently with the methodology used for Item (f). Registrants are required to use the same peer group they use for existing performance graph disclosures or compensation discussion and analysis.

- Net Income. This is simply GAAP net income for the relevant period.

- Company Selected Measure. This item is intended to represent the most important financial performance measure the registrant uses to link compensation paid to its PEOs and other NEOs to company performance. The registrant can select a GAAP or non-GAAP financial measure.

The remainder of this article focuses on the two shaded columns (c) and (e) which address Compensation Actually Paid and the valuation inputs that support these disclosures.

A new Pay Versus Performance table will detail the relationship between the Compensation Actually Paid, the financial performance of the registrant over the time horizon of the disclosure, and comparisons of total shareholder return.

3. What Is Compensation Actually Paid?

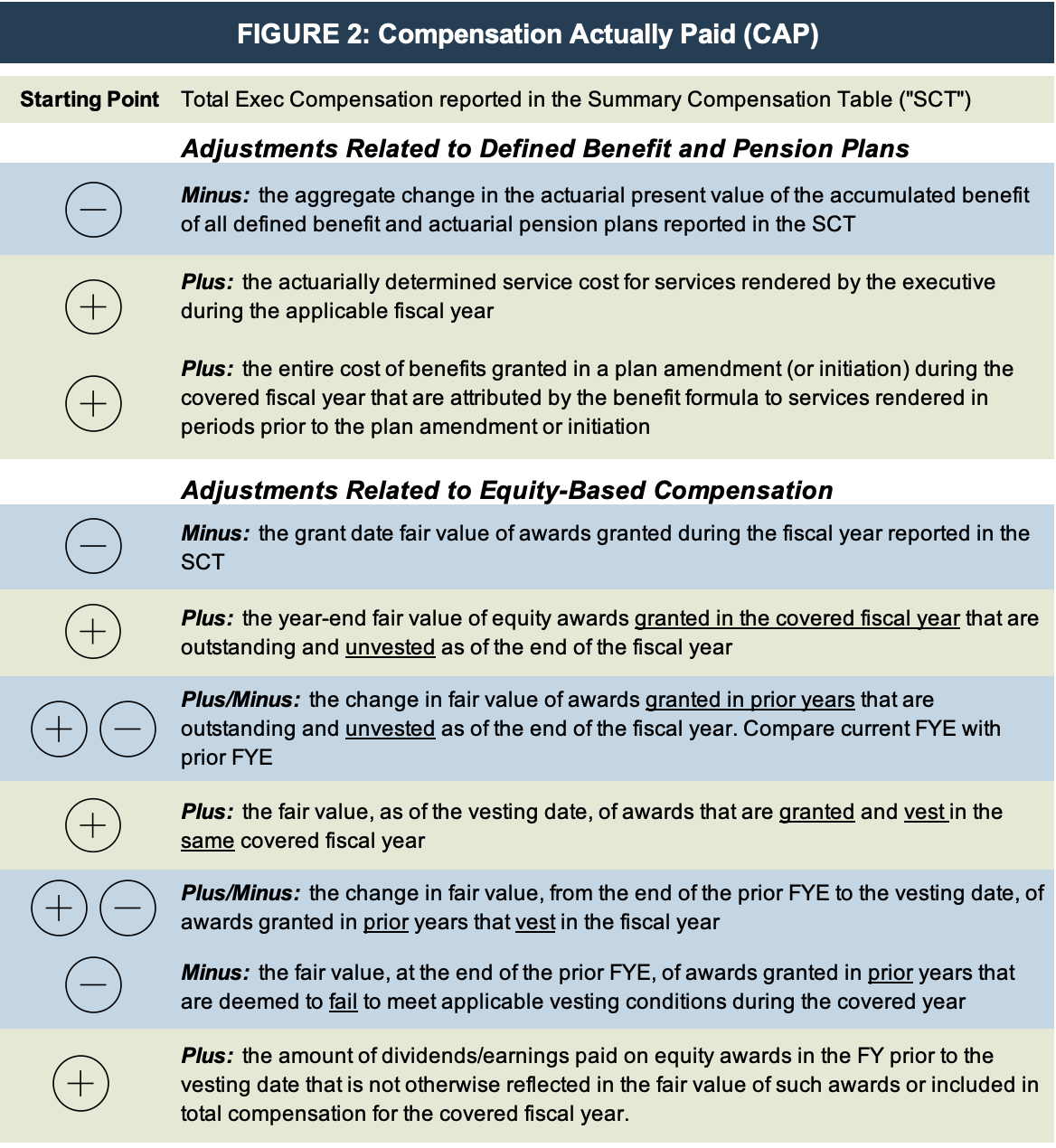

For each fiscal year, registrants are required to adjust the total compensation reported in Columns (b) and (d) for pension and equity awards that are calculated in accordance with US GAAP. The following table describes these adjustments in detail.

The pension-related adjustments should be calculated using the principles in ASC 715, Compensation – Retirement Benefits. The equity-based compensation adjustments will require registrants to disclose the fair value of equity awards in the year granted and report changes in the fair value of the awards until they vest. This means that it will be necessary to measure the year-end fair value of all outstanding and unvested equity awards for the PEO and other NEOs under a methodology consistent with what the registrant uses in its financial statements. For most registrants, this will be ASC 718, Compensation – Stock Compensation.

Appropriate footnote disclosure may also be required to identify the amount of each adjustment and any valuation assumptions that materially differ from those disclosed at the time of the equity grant.

The newly introduced concept of Compensation Actually Paid will require companies to measure the period-to-period change in the fair value of all equity-based compensation awarded to named executive officers.

4. What Are the Different Types of Equity Awards?

The procedures used to calculate fair value will vary depending on the type of equity award.

- For restricted stock and restricted stock units (RSUs), fair value can be calculated using observed share prices at the grant date, fiscal year-end, and the vesting date. The change in fair value would simply be the difference between these dates.

- For stock options and stock appreciation rights (SARs), fair value at the grant date is often calculated using a Black-Scholes or lattice model. Therefore, updated fair values at year-end and at the vesting date should be based on updated assumptions in those models, including current stock price, volatility, expected term, risk-free rate, dividend yield, and consideration of a sub-optimal exercise factor (in a lattice model). Care should be taken to ensure that expected term appropriately considers moneyness of the options at the new date. The use of historical and/or option-implied volatility should be evaluated for consistency and continued applicability.

- For performance shares and performance share units (PSUs), the fair value calculations may be more complex due to the presence of a performance condition (e.g., the award vests if revenues increase by 15% and EBITDA margin is at least 20%) or a market condition (e.g., the award vests if the registrant’s total shareholder return over a three-year period exceeds its peer group by at least 5%). The performance condition will require updated probability estimates at year-end and at the vesting date. Awards with market conditions are typically valued at their grant date using Monte Carlo simulation and so a reassessment at subsequent dates using a consistent simulation model with updated assumptions will be necessary.

The type of equity awards that have been granted will determine the complexity of the valuation process. Equity-based awards such as stock options might require updated Black Scholes or lattice modeling, while awards with performance or market conditions may require more complex Monte Carlo simulations.

5. Special Considerations for Market Condition Awards Using Monte Carlo Simulation

Market condition awards come in many different flavors. Three of the most common types of plans include:

- Market condition based upon performance in the registrant’s own stock. In this plan, vesting might be achieved if the registrant’s share price exceeds a certain level for a defined number of trading days or reaches an agreed-upon measure of total shareholder return.

- Market condition based upon relative total shareholder return. In this plan, the award vests based upon the registrant’s TSR in comparison to a similarly calculated TSR for a broad market benchmark index, an industry index, a peer company, or group of peer companies. Some plans employ a modification factor that adjusts the size of the award based upon varying levels of relative TSR performance.

- Market condition based upon ranked total shareholder return. In these plans, award vesting is based upon a numerical ranking of the registrant’s TSR against the TSRs of a group of peer companies or all of the companies on a particular broad market or industry index. The numerical or percentile ranking then determines the modification factor that adjusts the size of the award.

Each of the above plans has inputs and assumptions that drive the Monte Carlo simulation. When performing a subsequent year-end or vesting date fair value analysis, each of the grant-date assumptions will need to be reevaluated. For example, for a relative TSR plan with a three-year term, the subsequent year-end valuations will necessarily have shorter terms (2-year and 1-year), which will require new inputs for volatility and correlation factors. Shorter terms may make the use of option-implied volatility more relevant if sufficient market data is available.

For relative TSR plans that reference a group of companies or an index, some of the peers may have been acquired or merged in the subsequent periods. The plan documentation will often describe the steps to be taken when the composition of the peer group changes or there is a change in the benchmark index. A different group (or number) of companies will affect the correlation assumption as well as the percentile calculations in a ranked plan.

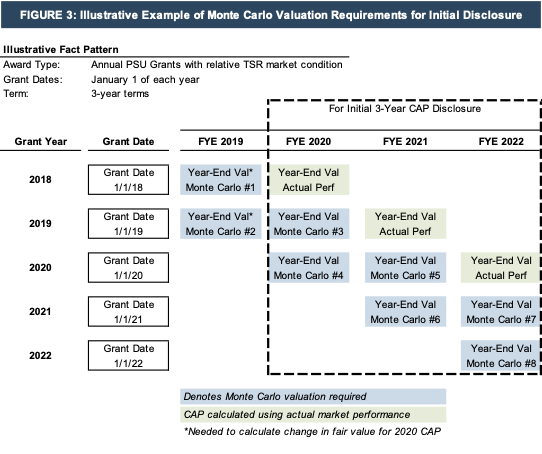

Regardless of the type of plan, it is important for registrants to understand how even a relatively simple award, if granted consistently for a period of years, can lead to a large number of Monte Carlo simulations for this initial proxy season and a significant amount of disclosure complexity.

As shown in Figure 3 below, if a company has made annual PSU grants (with a market condition) for each of the last five years, then up to eight Monte Carlo valuations could be required to calculate the CAP in each period.

Click here to expand the example above

In the example above, the blue boxes indicate when a valuation of prior grants would be necessary to calculate the change in fair value for each period of the CAP disclosure. For the final period of a relative TSR market condition plan, the company could use the actual market performance of its stock (and the comparative index) to calculate the expected value of the award.

Registrants should understand that if equity awards have been granted on a consistent basis for a period of years, the new rules could require a large number of historical valuations for this initial proxy season and a significant amount of disclosure complexity.

Summary and Next Steps

While the new SEC Pay Versus Performance disclosure rules can seem daunting, they can be managed with proper planning and a systematic approach. For the CAP disclosures, registrants need to understand the details of all equity awards that have been awarded to named executive officers (how many and what type of award). The award characteristics will determine which valuation method is most appropriate and how many valuations need to be performed.

If you have questions about the valuation techniques used for the various types of equity compensation awards or would like to discuss the process, please contact a Mercer Capital professional.