Key Takeaways for Auto Dealers from the 2023 AICPA Dealership Conference

Last month, we attended the 2023 AICPA Dealership conference and in this post present key takeaways from two sessions that are of interest to our blog readers: “Driving Success in Auto Retail” and “The Electrification of Auto Retail.”

Key Takeaways: “Driving Success in Auto Retail ” Session

This session was presented in the form of a conversation between Alan Haig of Haig Partners and Daryl Kenningham, CEO of Group 1 Automotive. Group 1 Automotive owns approximately 205 auto dealerships in the United States and the United Kingdom and boasts approximately $16 billion in annual revenues. They specifically own 150 auto dealerships in the United States, with headquarters and a high concentration of dealerships in the Houston, Texas market. (For information on other publicly traded auto dealers, see our ongoing blog series featuring profiles on Asbury Automotive Group, Auto Nation, Sonic Automotive, and Lithia Motors.)

Here are the key takeaways for our readers.

The Service Experience for Tesla Consumers May Not Be Optimal

While Tesla consumers have loved the direct sales model buying experience, they have not enjoyed the service experience. As we’ve discussed, franchised auto dealers have implemented elements of the direct sales model through digital/online platforms. Unlike Tesla, franchised auto dealers have physical locations near their customer bases and are more equipped to provide ongoing service for the life of their vehicles.

There Is a Used Car Shortage

With more focus on the shortage of new vehicles produced in the last three years caused by the pandemic and microchip shortage, the shortage of used vehicles hasn’t been as widely discussed. Fewer new vehicles sold leads to fewer trade-ins, which leads to fewer used vehicles for sale. Mr. Kenningham estimated that 8 million fewer used cars are available in the system even though approximately 40 million used vehicles trade hands annually. Also contributing to the system’s shortage of used vehicles are consumers maintaining their current vehicles longer, fewer new units available, as well as affordability issues.

There Is a Technician Shortage

Group 1 and other auto groups have countered the lack of skilled technicians in the workforce by gradually raising labor rates. While this strategy has been effective, it has led to costlier repairs on average and, eventually, a ceiling on these increased rates. Mr. Kenningham estimated that an empty service bay would cost the company $17,000 in gross profit each month.

It Is Hard to Retain a Service Department Customer

Mr. Kenningham estimated that Group 1 and other franchised auto dealers only retain approximately 2/3 of service customers from new vehicles they sell directly. The Service Department is one of the higher margin segments in the auto dealership business model; therefore, it’s important for dealers to try to retain more ongoing service work for their current customers. While oil changes and tire rotations are not very profitable to auto dealers, they provide frequent/additional opportunities for the auto dealer to service the customer.

Younger Customers Are Not Loyal Customers

Younger customers are more inclined to seek out the purchase of a new automobile on a digital platform because of the comfort of making material purchases in that format. However, younger customers tend to be less loyal in the long run, so auto dealers must strike a balance in their sales offering methods to the customers.

The 3 Things Dealers Should Focus On

Consistent with these trends and observations, Mr. Kenningham listed three things that auto dealers should focus on in the future:

- Invest in technology,

- Invest in customers, and

- Drive scale into all elements of your business model.

Key Takeaways: “The Electrification of Auto Retail – 2023 Update” Session

This presentation by Capital Automotive provided a snapshot of the current landscape for the electric vehicle (EV) market as well as a comparison of industry conditions and headwinds in 2021 versus 2023. Specifically, the headwinds in 2021 were cost parity to traditional internal combustion engine (ICE) vehicles, consumer adoption/demand, and the charging network. These headwinds primarily still exist in today’s environment.

Affordability and Value Retention Are a Question Mark

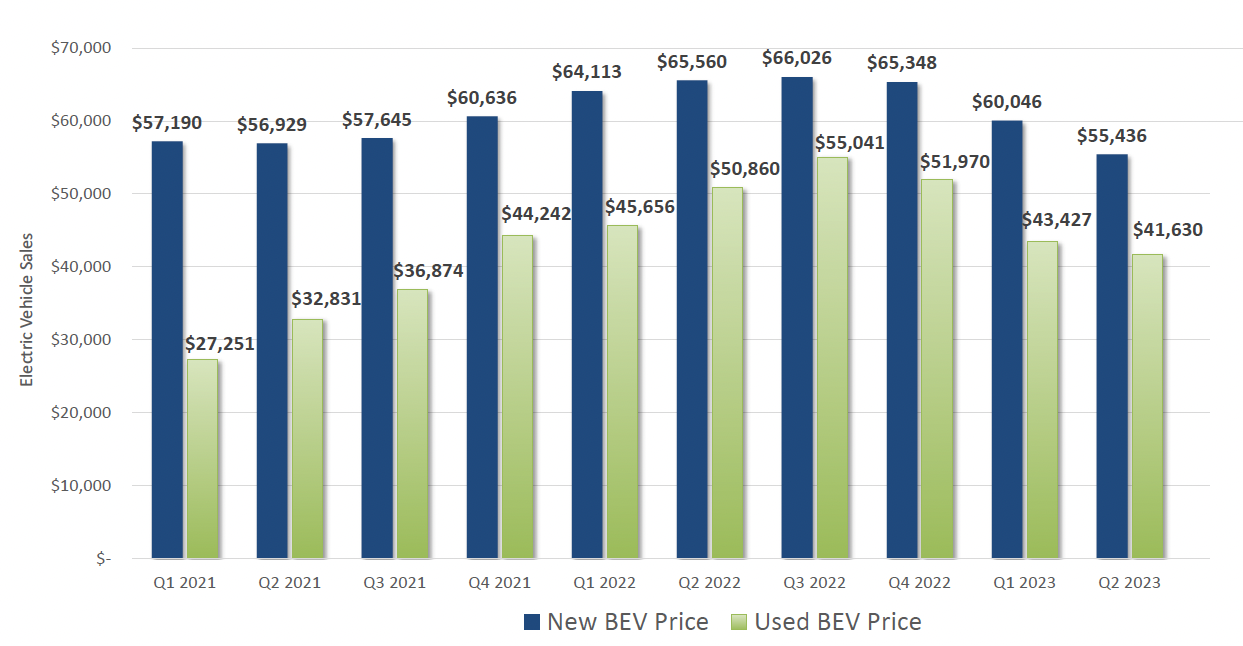

The following graph from information provided by Cox Automotive details the average new and used price trends from battery electric vehicles (BEVs):

Click here to expand the image above

In September 2023, the average transaction price for a new BEV totaled $55,436 compared to the $47,899 average transaction price for all new vehicles (Cox Automotive). For used vehicles, the average transaction price for BEVs was $41,630 compared to $28,935 for all used vehicles (Edmunds).

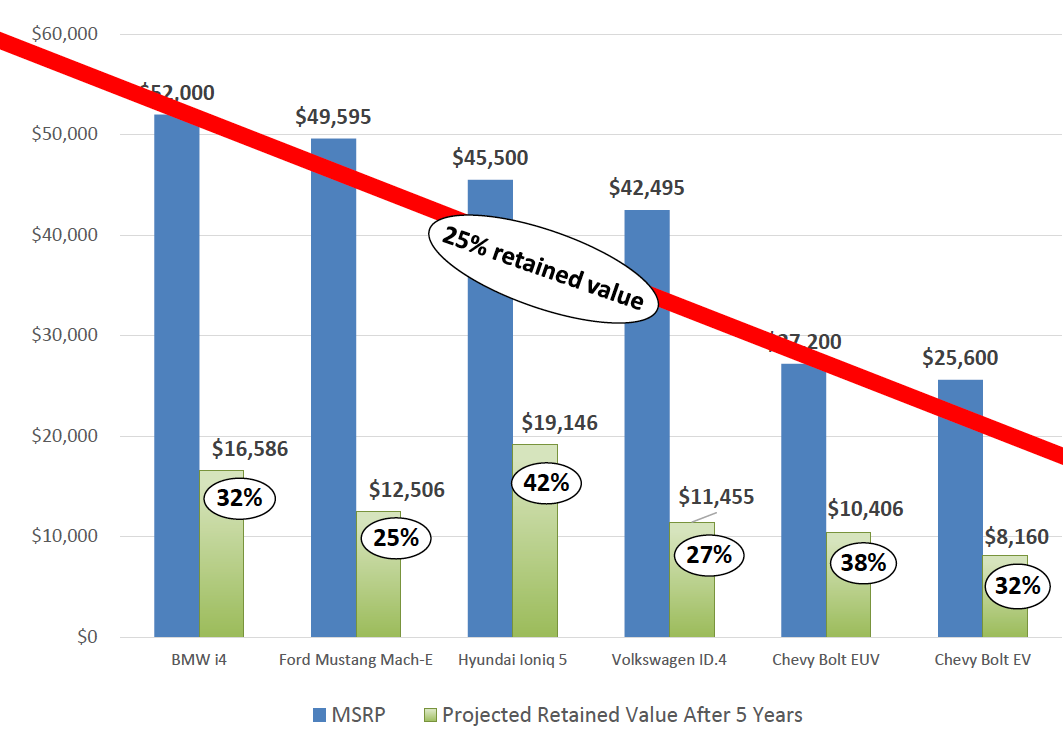

In addition to higher transaction prices, the six BEV models in the following graph are projected to lose 25%-42% of their value five years after purchase. This may seem like a high percentage, but for comparison, Capital Automotive noted that an iPhone 11 lost ~75% of its value five years after purchase.

Click here to expand the image above

Finally, Capital Automotive provided two other views of the affordability of BEVs/EVs. The first data point examined the cost of ownership of an F150 Platinum Truck (ICE) versus an F150 Lightning (BEV) comparing the cost of fuel, average insurance premiums, fees & taxes, interest financing, repairs & maintenance, and depreciation. The BEV (F150 Lightning) was 21% more expensive to own (by ~$4,000) than the ICE (F150 Platinum Truck) even though the BEV had lower fuel and repairs & maintenance costs.

The second data point offered by Capital Automotive related to the cost of 2024 BEV models. According to Car & Driver, CNET, Kelly Blue Book, and U.S. News, 20 new BEV models are being introduced to the market in 2024. Only five of those models (Cadillac Celestiq, Chevy Equinox EV, Fiat 500e, Honda Prologue, and Volvo EX30) will be offered at prices below the average transaction price for all new vehicles.

Consumer Demand Has Grown But …

Based on the statistics of U.S. new light vehicle sales, the EV unit’s share of the market is 8.6% as of June 2023, according to Automotive News. While this figure remains a small percentage of the overall market, it has grown from a meager 0.1% in just six and a half years.

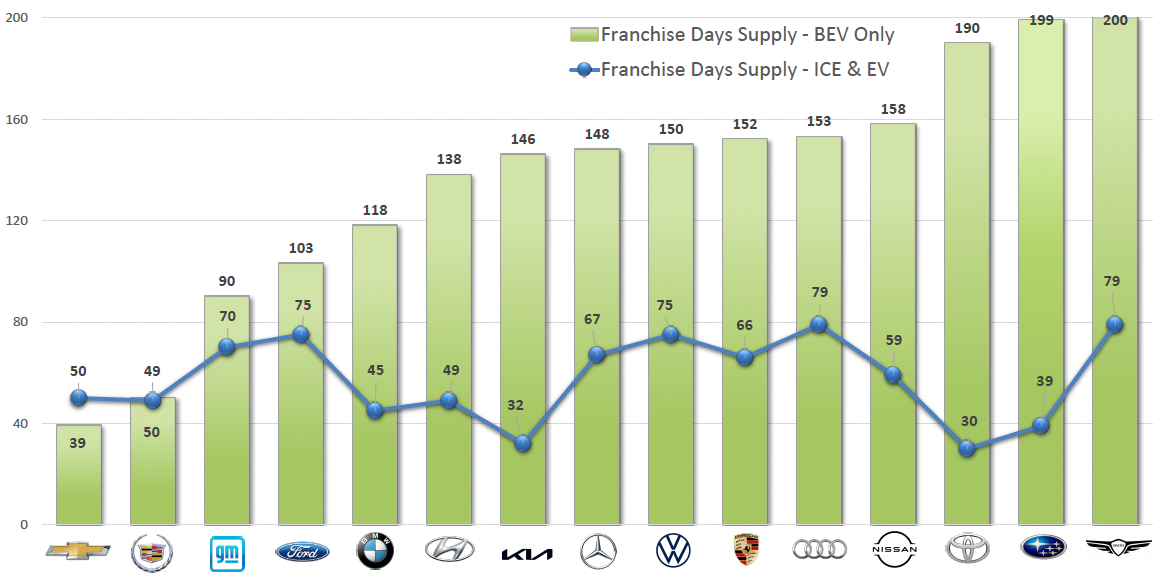

Another way to view consumer demand is in inventory levels, as seen in the graph below presented by Capital Automotive.

Click here to expand the image above

Other than Chevrolet and Cadillac, EVs’ average days’ supply and inventory levels are higher than traditional ICE vehicles for all other manufacturers listed above. Dealers have plenty of EV inventory on their lots, but the pricier EV models are not selling as quickly and are beginning to pile up.

The states with the fastest EV adopters are mostly in the west and northwest (California, Washington, Oregon, Nevada, Arizona, and Colorado). The states with the slowest EV adopters represent more of the country’s rural areas (Wyoming, Iowa, Arkansas, Mississippi, South Dakota, North Dakota, and West Virginia).

Charging Infrastructure Is Not Sufficient

The specific needs of EVs, such as charging levels and requirements and infrastructure investments, are well-known in the industry. Additional challenges have been presented by fires caused by the combustion of lithium batteries in EVs in apartment buildings, airport parking garages, and cargo ships. According to a 2023 Electrical Safety Foundation Survey, 50% of homes in the United States do not have electrical systems capable of the continuous load required for EV charging, and 54% of all homes would require an electrical panel upgrade to facilitate EV charging.

Conclusion

The recent AICPA Dealerships conference provided a great forum to discuss current trends in the auto dealer industry and predictions for the future. It’s also informative to hear how individual dealerships are confronting their own unique challenges. All of these trends/factors will continue to impact the operations of dealerships and, ultimately, their profitability and valuation.

Mercer Capital provides business valuation and financial advisory services, and our auto team assists dealers, their partners, and family members to understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your auto dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights