Opportunity in 2020’s Devaluation of the Oilfield Services Industry

Reduced Valuations Present Possibilities for Tax-Efficient Transfers

Year-end 2020 saw a flurry of tax-purposed project activity across all of Mercer Capital’s offices, with clients’ Estate Planning Counsel having recommended numerous gifts and other estate planning related transactions before 2020 came to a close. While we are all happy to have put 2020 in the rearview mirror, the passing of December 31st does not mean that the gifting opportunity has elapsed. Despite some level of recovery for parts of the Oilfield Services industry during Q4-2020, valuations remain at significantly depressed levels from where they were prior to March 2020. In addition, early indications of the Biden Administration’s intentions in regard to estate taxation indicate that the benefit of estate planning transactions will likely be greater in 2021 than in 2020.

OFS Valuations Remain Near 5-Year Lows

While the suffering of businesses in 2020 was certainly wide-spread, the upstream energy industry was particularly pummeled. Mercer Capital’s Energy Valuation Insights posts over the course of this last year detailed the impact of the pandemic’s demand, destruction, and world-wide oil price disruption on E&P companies and the OFS companies that serve the energy industry’s upstream sector. While OFS prices showed some recovery since October, valuations remain sharply reduced.

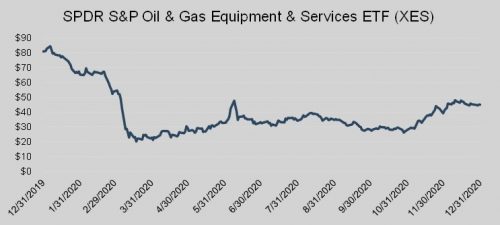

Using the SPDR S&P Oil & Gas Equipment & Services ETF as an OFS industry barometer, we see that although the OFS industry showed an encouraging 64% increase during the last two months of the year, valuations remain 45% percent below the January 1 level.

The struggles in the OFS industry are further evidenced by the many OFS bankruptcies seen during 2020. Certainly, service and equipment providers with customer concentrations in certain basins have experienced less severe devaluations than others, but few escaped 2020 unscathed.

A marked decline in valuation is never a positive to a business. However, a temporary reduction in value (as even the 2020 decline is expected to be), can allow for advantageous estate planning transfers of business interests. During a value downturn, an owner of a business or interests in a business, can transfer larger ownership interests with a smaller tax bite or with a smaller portion of the gift and estate tax exemption being used-up.

The Tax-Man Cometh

As referenced above, the Biden Administration has already indicated wealth transfers are “in their sights”, with plans to increase the estate tax rate, and reduce the estate tax exemption amount by a reported 40%. While the exemption currently stands at $11.7 million, expectations are that the new Administration will likely return the exemption to the pre-Tax Cuts and Jobs Act (2017) level of $7.0 million. With the Democrat party now controlling the White House and both chambers of Congress, expectations are for more significant changes to U.S. tax policy than if control of Congress’ two chambers were split between the two political parties. Whether the changes will be purely forward impacting, or retroactive to January 1st, remains to be seen. Needless to say, professionals active in estate planning will be watching closely, and will likely be busy again in 2021. See Mercer Capital’s Family Business Director’s blog from January 11 for insights to what the impacts on estate planning will be.

The Valuation Discount Advantage

Minority interest and marketability discounts, are an important, and well established, part of the valuation of a business, or a business interest. In Estate and Gift Tax purposed business appraisals reasonable application of these tried and true valuation concepts are frequently based on the specific facts and circumstances, leading to significant reductions in the reported value of a transferred business interest, resulting in a much lower tax liability. Mercer Capital has successfully defended its minority interest and marketability discounts in tax court settings throughout the firm’s nearly 40 year history.

Through the gifting of minority interests in a business, the interest owner not only benefits from these discounts reducing the reported transferred business interest’s value at the time of the gift being made. When performed as a part of a carefully crafted estate planning strategy, the gifting of minority interests can lead to a non-controlling ownership interest in an estate, thereby allowing for the application of the same discounts for estate tax purposes as well.

A recent post by Mercer Capital’s Travis Harms addressed these matters and includes examples that illustrate the potential reduction in tax liability across multiple gifting scenarios. A well devised business interest gifting strategy as part of an overall estate plan, can substantially reduce estate taxes and increase the value transferred to one’s heirs.

Conclusion

Even though 2020 is now behind us, and OFS industry values have experienced a partial, albeit tepid, recovery, the window for strategic business interest gifting transactions remains open and viable. Mercer Capital has been providing valuation and other financial advisory services since 1982 to families seeking to optimize their estate plans. Call one of our professionals today to discuss how we can help you in the current OFS industry environment.

Energy Valuation Insights

Energy Valuation Insights