Making Sense of 2020: Part 4

History, Valuation & the Future

It makes sense that stock prices reflect financial performance, and over the long run they do. So how to explain 2020, which saw corporate earnings devastated by the pandemic and stock indexes soaring to all-time highs?

We’ve covered the pandemic’s affect on the operating, investing, and financing decisions made by public companies in our last three posts. This week, we conclude by examining shareholder returns.

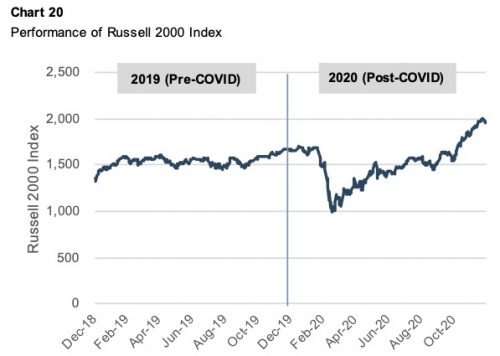

Chart 20 summarizes the performance of the Russell 2000 index (small cap shares) during 2019 and 2020.

At the onset of the pandemic, the index fell precipitously. This is pretty easy to understand: investors don’t like risk, and risk was everywhere in the spring of 2020. During the second and third quarters, investors began to feel that they had a handle on the pandemic. In other words, investors grew increasingly comfortable that the long-term economic impact of the pandemic could be reasonably estimated. By the end of 3Q20, the index value had returned to pre-pandemic levels.

When thinking about valuation, it is important to recall that the emphasis is always on the future. When the end of 3Q20 rolled around, it was clear that earnings for 2020 would be impaired because of the pandemic – so how could share prices be at the same level? Because the lower earnings for 2020 no longer mattered; the market was focused on earnings expectations

for 2021 and beyond.

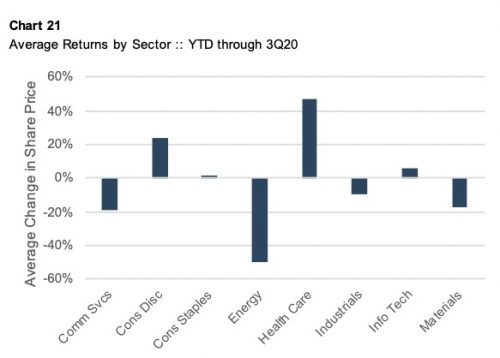

Chart 21 shows that, while the market as whole had recovered by the end of 3Q20, not all companies did. Different industries fared differently. For example, healthcare shares increased sharply while energy shares were devastated.

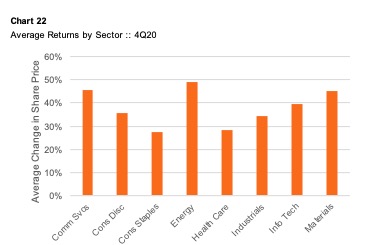

The storyline changes when we turn our attention to market performance in the fourth quarter of 2020. As shown on Chart 20, the index value surpassed pre-COVID levels by almost 20%. Chart 22 summarizes average share price changes by industry for the fourth quarter of 2020.

In contrast to the share price performance during the first three quarters, the uplift in market prices during the fourth quarter was broad, with all sectors posting substantial average share price gains.

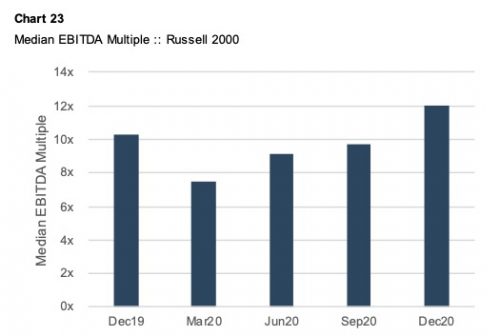

Share prices change when earnings change and/or earnings multiples change. As shown in Chart 23, increasing earnings multiples played a significant role in the share price gains during the fourth quarter of 2020.

Earnings multiples are defined by investor expectations for growth and returns.

- Growth. From the existing base, how fast are earnings expected to grow in the future? The faster the expected growth, the higher the earnings multiple. As visibility into vaccine pipeline increased during the quarter, investors may have been willing to credit companies with higher growth prospects.

- Returns. What return are investors demanding? Returns are the sum of the yield on risk-free assets plus a premium to compensate investors for taking risk. All else equal, investor returns are inversely related to earnings multiples. The increase in multiples during 4Q20 suggests that required returns decreased. Since risk-free returns increased during the period, the return premium received for taking risk likely fell more dramatically.

Takeaways for Family Business Directors

What does all of this mean for family business directors? The effect of the pandemic on business operations has been well-documented. However, for most family businesses it is time to move on from the survival mindset

required during 2020.

How will your family business grow in a post-pandemic world?

One message from the stock market run-up during 4Q20 is that public market investors are expecting growth. Even if you think your family shareholders are different, public market sentiment likely shapes the behavior of your competitors and will influence what happens in your industry whether you want it to or not. In the wake of changes to supply chains and distribution channels, what new strategies will your family business need to adopt to compete and grow in the post-COVID world?

How will you adapt to a lower cost of capital?

The cost of capital is the price of money, and family businesses are ultimately price takers in the capital markets. While family shareholders may be protected from short-term public market volatility, public capital market trends do affect family businesses in the long-term. Regardless of whether you assign the cause to central bank actions or shifting investor sentiment, the overall cost of capital was probably lower at the end of 2020 than at the beginning of the year. This has significant implications for how family businesses evaluate and make distribution, investment, and capital structure decisions.

These questions rarely have simple answers. Give one of our family business professionals a call to discuss what adjustments may be appropriate to help your family business thrive in the post-COVID world.

Family Business Director

Family Business Director