RIA M&A Update

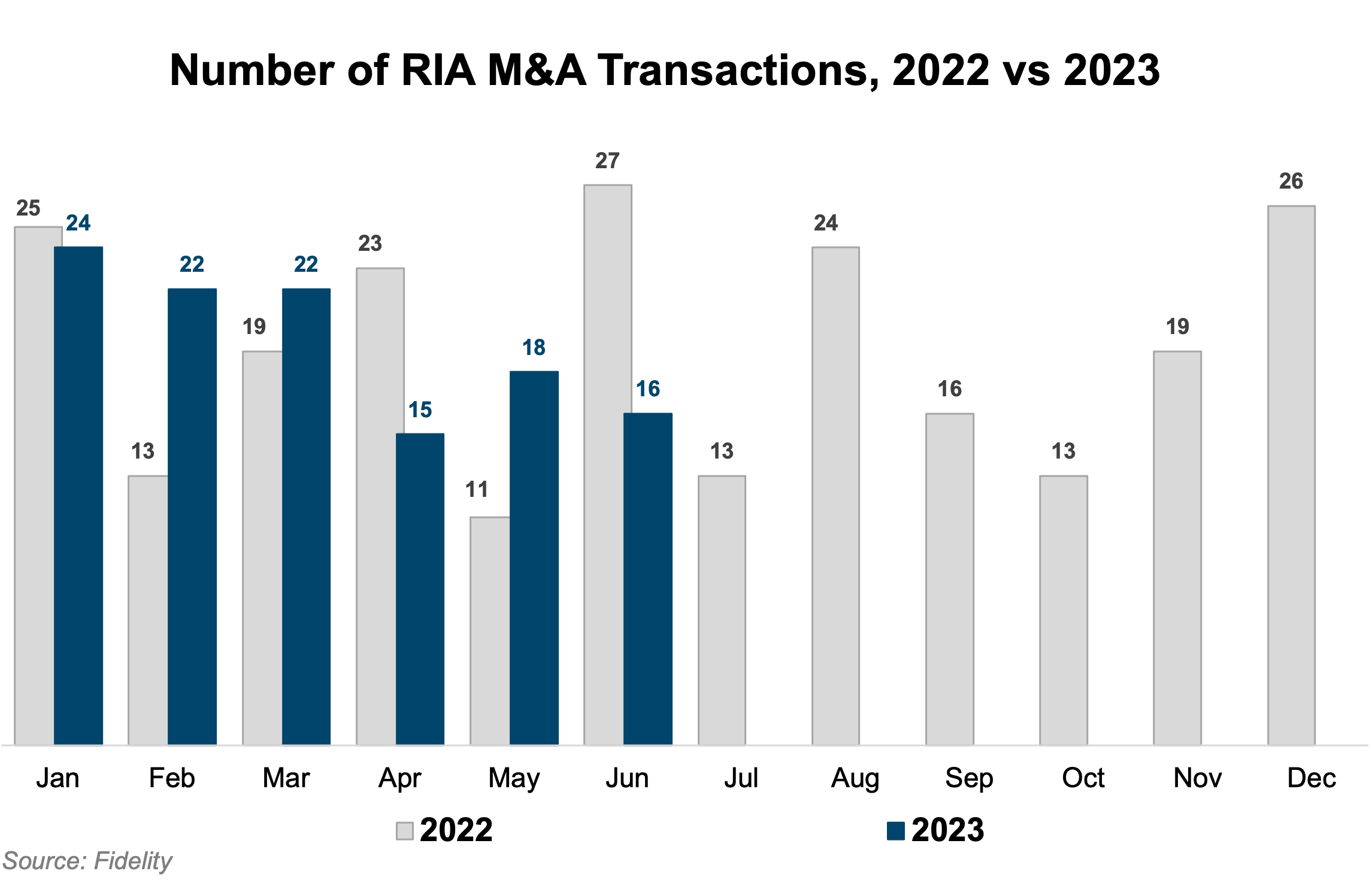

Although inflation has begun to subside and the stock market has rallied after a turbulent start to 2023, elevated interest rates and macroeconomic uncertainty have contributed to a slight decline in deal volume during the first half of 2023. Fidelity’s June 2023 Wealth Management M&A Transaction Report listed 117 deals through June 2023, down 1% from the 118 deals executed during the same period in 2022. Despite the slight decline in deal volume, total transacted AUM was $176.4 billion—a 10% increase from the same period in 2022.

While deal volume during the first half of 2023 was roughly in line with 2022, there was a notable slowdown during the second quarter of 2023. Fidelity’s transaction report listed 49 deals in the second quarter, representing a 20% year-over-year decline in deal count.

Relative to the broader M&A market, RIA deal activity has been remarkably resilient. The overall M&A transaction value for all industries in the U.S. decreased 44% in the first half of 2023 compared to 2022 (per S&P Global). Over the same period, total transacted AUM (a proxy for transaction value) for RIAs increased by 10%. The average AUM per transaction during the first half of 2023 was $1.5 billion, a 16% increase over the prior year. The increase in deal size has been an encouraging sign, given the rise in the cost of capital over the past year. Echelon’s Q2 2023 RIA M&A Deal report states, “Firms with over $1 billion in AUM have been especially attractive to buyers as they tend to have experienced management and established processes and platforms”. This growth in deals with AUM over $1 billion can also be attributed to the recovery of financial markets raising AUM levels overall in the industry.

Another contributor to the increase in deal size has been RIAs partnering with private equity firms. According to Echelon’s Q2 2023 RIA M&A Deal report, private equity acquirers directly invested in wealth managers with assets totaling $351 billion in the second quarter of 2023, more than doubling the amount in 2022. This increase was due to some of the largest wealth management consolidators taking on new private equity partners. Notable transactions of this nature include CI Financial, which sold a 20% interest in its U.S wealth management business, CI Private Wealth, to a group of institutional investors, including Abu Dhabi Investment Authority, Bain Capital, Flexpoint Ford, Ares Management, and the state of Wisconsin.

The prevalence of serial acquirers and aggregators has continued in the RIA M&A market. In recent years, the professionalization of the buyer market and the entrance of outside capital have driven demand and increased competition for deals. Serial acquirers and aggregators have increasingly contributed to deal volume, supported by dedicated deal teams and access to capital. Such firms accounted for approximately 68% of transactions through the half of 2023. Mariner, CAPTRUST, Beacon Pointe, Wealth Enhancement Group, and Focus Financial all completed multiple deals in the half quarter of 2023.

On the supply side, the current market environment will likely have a mixed impact on bringing sellers to market. On one hand, some sellers may be reluctant to sell when the markets (and their firm’s financial performance) are down from their peak. On the other hand, a concern that multiples may decline if the current market environment persists may prompt some sellers to seek an exit while multiples remain relatively robust. This dynamic has prompted many sellers to hedge their exit by pursuing a partial sale now with an eye for a more complete exit once market conditions improve.

While market conditions play a role in exit timing, the motives for sellers often encompass more than purely financial considerations. Sellers are often looking to solve succession issues, improve quality of life, and access organic growth strategies. Such deal rationales are not sensitive to the market environment and will likely continue to fuel the M&A pipeline even during market downturns.

What Does This Mean for Your RIA?

For RIAs planning to grow through strategic acquisitions: Pricing for RIAs has trended upwards in recent years, leaving you more exposed to underperformance. While the impact of current macro conditions on RIA deal volume and multiples remains to be fully seen, structural developments in the industry and the proliferation of capital availability and acquirer models will likely continue to support higher multiples than the industry has seen in the past. That said, a long-term investment horizon is the greatest hedge against valuation risks. Short-term volatility aside, RIAs continue to be the ultimate growth and yield strategy for strategic buyers looking to grow their practice or investors capable of long-term holding periods. RIAs will likely continue to benefit from higher profitability and growth than their broker-dealer counterparts and other diversified financial institutions.

For RIAs considering internal transactions: We’re often engaged to address valuation issues in internal transaction scenarios, where valuation considerations are top of mind. But how the deal is financed is often a crucial secondary consideration in internal transactions where buyers (usually next-gen management) lack the ability or willingness to purchase a substantial portion of the business outright. As the RIA industry has grown, so too has the number of external capital providers who will finance internal transactions. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and, in some instances, may still be the best option). Still, an increasing amount of bank financing and other external capital options can provide selling partners with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

If you are an RIA considering selling: Whatever the market conditions are when you go to sell, it is essential to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. As the RIA industry has grown, a broad spectrum of buyer profiles has emerged to accommodate different seller motivations and allow for varying levels of autonomy post-transaction. A strategic buyer will likely be interested in acquiring a controlling position in your firm and integrating a significant portion of the business to create scale. At the other end of the spectrum, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference. Given the wide range of buyer models out there, picking the right buyer type to align with your goals and motivations is a critical decision that can significantly impact personal and career satisfaction after the transaction closes.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights