Auto Dealer Insights: Best of 2023

We are about to put a bow on 2023! Our weekly posts follow the auto industry closely to keep up with market trends and gain insight into the private dealership market. We hope you have enjoyed our content in 2023, and we look forward to connecting further in 2024! Below, we have recapped four of our popular topics.

Auto Industry Trends to Monitor in 2023

Early in the year, we wrote a post discussing a potpourri of trends to monitor in 2023, coming off specific statistics from 2022. We discussed new vehicle pricing, used vehicle pricing, electric vehicles, connected cars, and SAAR predictions for 2023. As we close out 2023, we revisit some of these topics and predictions in hindsight.

The average transaction price for new vehicles continued to rise in early 2023 before flattening out and eventually declining. As of the most recent data, the average transaction price of new vehicles stood at $45,332 in November, representing a decline ranging from 1.5-2%, depending on the source. Consistent with those trends, incentives on new vehicles have steadily risen and now comprise approximately 4.5-5%, depending on the source. Finally, the percentage of new vehicles selling above MSRP is 21.4%, compared to nearly 37.1% from this time last year, according to JD Power/LMC. All of these trends indicate that we are shifting from a seller’s market to a buyer’s market for automobile consumers.

Average transaction prices for used vehicles also followed suit, posting a figure of $29,985 for November, a decline of approximately 2.9% from November 2022.

Avid readers are familiar with our monthly SAAR reports. With a strong December, which is typically the strongest selling month of the year, the annual SAAR is expected to land somewhere in the area of 15.6 million units. As a point of reference, predictions for 2023 ranged from 14.1 to 15 million from industry experts such as Edmunds, Cox Automotive, NADA, and Toyota North America. After underperforming expectations in 2022, predictions were reigned in, and the rebound materialized in 2023, outstripping expectations.

EV Potpourri

According to Automotive News, EVs continued to increase market share, with estimates ranging from approximately 7% at the beginning of the year based on the total number of new vehicle registrations to 8.6% in June. This post discussed the different charging levels, various requirements automakers have for their dealers, and the expanding presence of charging stations at retailers and restaurants.

Later in the year, we discussed the recent development of EV affordability, as well as a view of consumer demand measured by days’ supply of EV inventory versus all vehicles. EVs continue to be more expensive than their internal combustion engine (ICE) counterparts, with average transaction prices of $55,436 and $41,630 for new and used EVs, respectively. Only five of the twenty new EV models to be introduced in 2024 will be offered at prices below the average transaction price for all new vehicles.

While production of EVs has increased, the amount of EV inventory on dealers is beginning to mount, perhaps reflecting a softening interest in these models. For all OEMs other than Chevrolet and Cadillac, the days’ supply of inventory for EVs is far more than the days’ supply of all new vehicle inventory. Stated simply, EV inventory is sitting on dealers’ lots for extended periods compared to ICE vehicles.

Ford recently announced it is scaling back its $3.5 billion Michigan battery plant as EV demand has declined and labor costs have increased.

United Auto Workers Strike

The increase seen in labor costs is due to the UAW strike, which began on September 15th and ended on November 20th, when new deals were ratified. Our October 6th post chronicled the strike in real time, including insights into why the union was striking, the key players in negotiations, and how this strike differed from previous ones. Historically, the UAW only targeted one OEM at a time during a strike. But as this was the first simultaneous strike against the Big 3, it enabled the UAW to use concessions by one OEM as negotiation leverage with the others. Possibly learning from the recent supply chain constraints, the strikes also targeted specific factories that produce the most popular and profitable vehicles, allowing the UAW to inflict maximum economic pain while limiting the interim losses of its striking members.

The new contract gave union workers an immediate pay increase of 11%, and union members will get a total pay increase of 25% throughout the 4½-year deal. The new contracts also reinstated cost-of-living adjustments, let workers reach top wages in three years instead of eight, and protected their right to strike over plant closures.

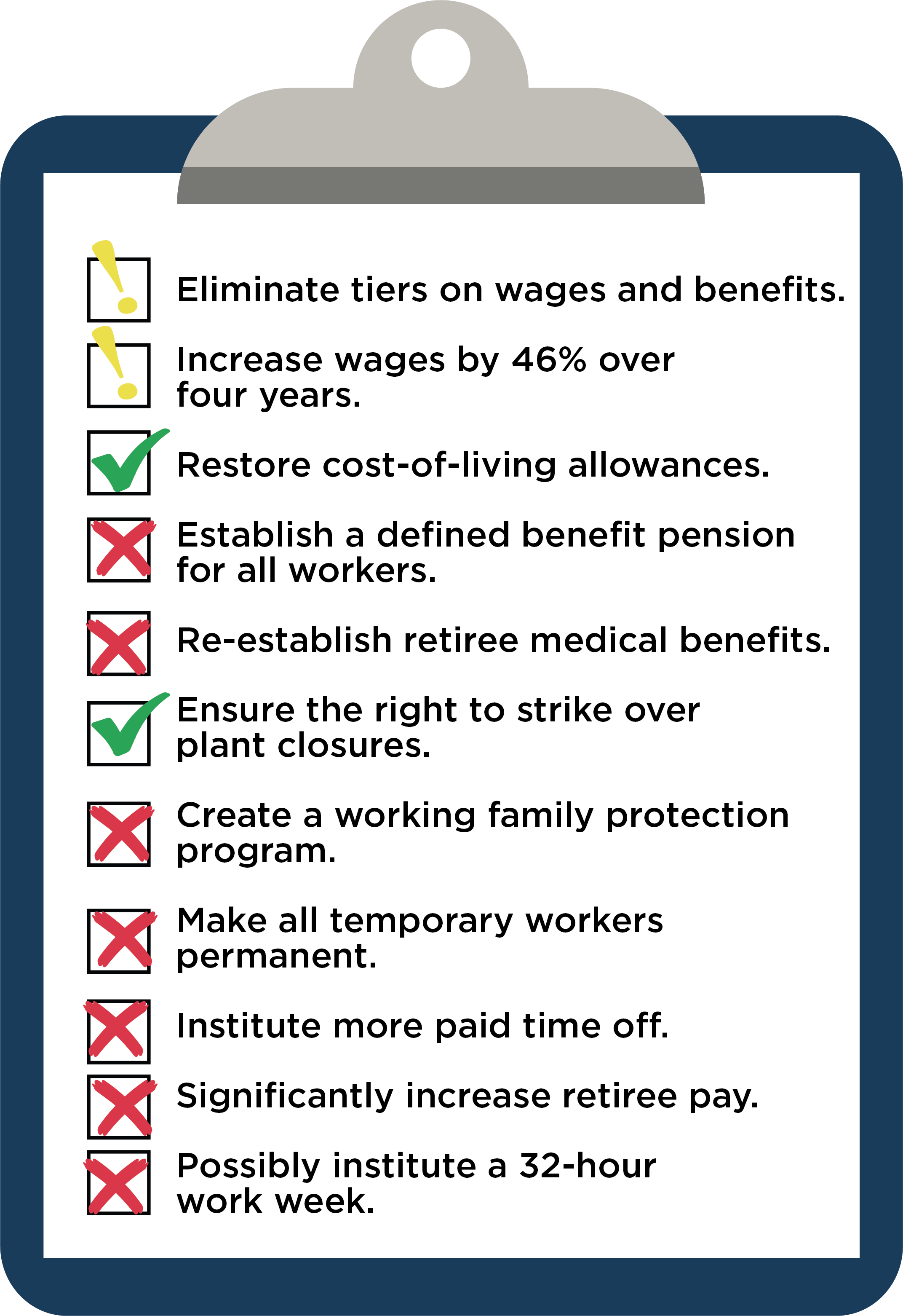

For comparison sake, we noted reports that the UAW was seeking:

As expected, the UAW gained some valuable concessions but also didn’t get everything they were seeking.

Floorplan Interest Income Fading

In the post-COVID and supply chain-constrained boom, auto dealers enjoyed an unlikely profit center: floorplan interest. Floorplan loans are provided to dealers by banks, specialty lenders, and vehicle manufacturers. Interest accrued on these loans is called floorplan interest, and in the time between when the vehicle is acquired by the dealer and sold to a consumer, the dealer must pay floorplan interest expense to the lender. The longer the vehicle sits on the lot, the longer interest accrues.

When dealers started selling vehicles as soon as they arrived at the dealership, floorplan credits exceeded floorplan interest expense. Normally a cost of doing business, low interest rates coupled with depressed inventories meant the sales-volume-based credits many dealers receive from their OEM exceeded the financing cost of holding vehicles on the lot.

As we noted in our post this year, this began to fade in 2023 as inventories recovered and rates remained elevated. With no end in sight, they continued to rise as many Fed watchers anticipated a “higher for longer” interest rate environment.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights