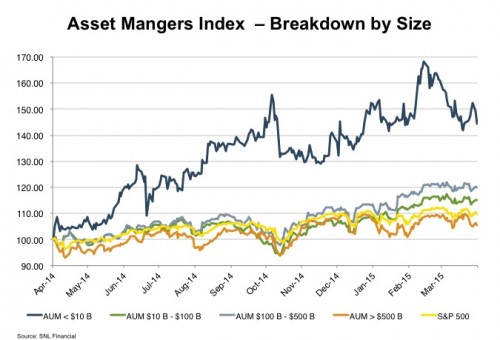

Smaller asset managers outperformed their larger brethren over the last year. Still, it’s important to remember that our smallest sector of asset managers (AUM under $10 billion) is the least diversified and therefore most susceptible to company-specific events.

Its strength is more attributable to DHIL’s (~80% of the market-weighted index) outsized gain in market value rather than any indication of investor preference towards smaller RIAs.

Its strength is more attributable to DHIL’s (~80% of the market-weighted index) outsized gain in market value rather than any indication of investor preference towards smaller RIAs.

For closely held RIAs, size appears to be more prevalent at least at a certain asset level. Managers with less than $100 million in AUM typically lack the profitability of a billion dollar plus RIA though exact breakeven points tend to vary with location and fee structure. The inherent operating leverage of the asset management business allows margins to expand with AUM as the incremental expenses associated with rising fees can be relatively minimal. Higher AUM balances can also serve as a cushion against future losses from client attrition and may lead to higher valuations though pricing also comes down to growth prospects, which can be more of a challenge for the larger managers.

For closely held RIAs, size appears to be more prevalent at least at a certain asset level. Managers with less than $100 million in AUM typically lack the profitability of a billion dollar plus RIA though exact breakeven points tend to vary with location and fee structure. The inherent operating leverage of the asset management business allows margins to expand with AUM as the incremental expenses associated with rising fees can be relatively minimal. Higher AUM balances can also serve as a cushion against future losses from client attrition and may lead to higher valuations though pricing also comes down to growth prospects, which can be more of a challenge for the larger managers.

Mercer Capital's RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry