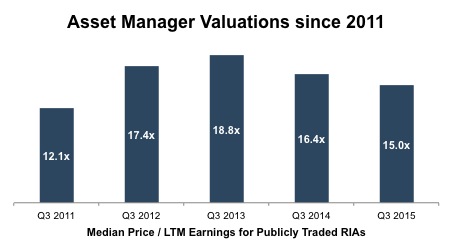

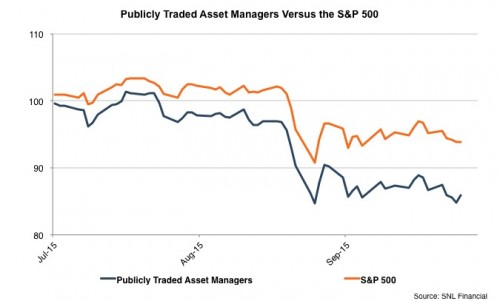

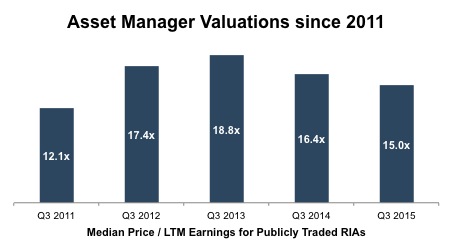

Q3 was an especially bad quarter for asset managers, with the group losing over $40 billion in market capitalization during a six week skid. Given the sector’s run since the last financial crisis, many suggest this was overdue and only pulls RIA valuation levels closer to their historic norms. The multiple contraction reflects lower AUM balances and the anticipation of reduced fees on a more modest asset base.

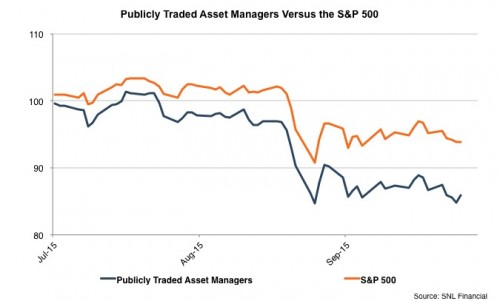

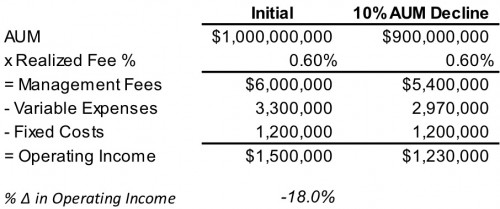

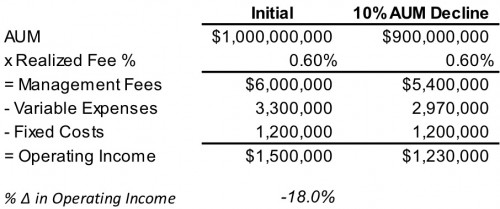

The most recent sell-off brings the industry to the brink of a bear market despite the S&P being down only 10% or so over the last few months. Such underperformance is not surprising for a business tethered to market conditions and investor sentiment. The market is acknowledging that revenue for equity managers is directly tied to index movements and earnings often vary more than management fees due to the presence of fixed costs (as demonstrated in the example below). Combining these dynamics with some multiple contraction reveals the market’s rationale for discounting these businesses in recent weeks.

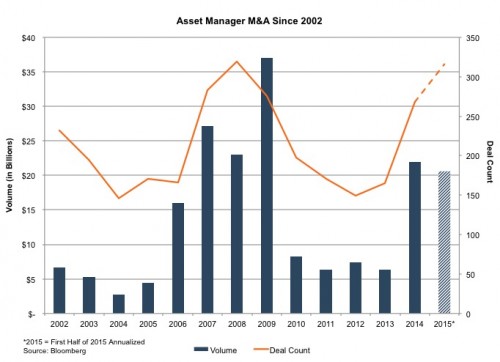

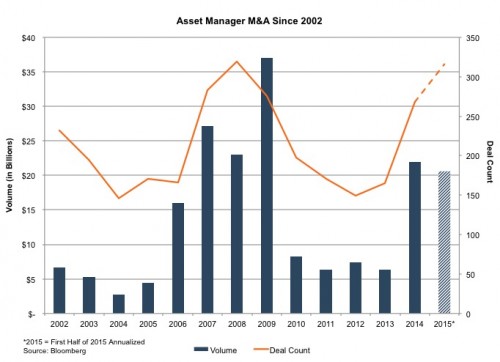

The impact on sector M&A is more nuanced. On the one hand, the lower price tag might entice prospective buyers fearful of overpaying. Yet for others the market’s recent variability could spook potential investors, and sellers may be less inclined to part with their businesses at a lower valuation. Though the third quarter figures aren’t out yet, the recent slide could curtail the deal making momentum we’ve witnessed over the last year-and-a-half.

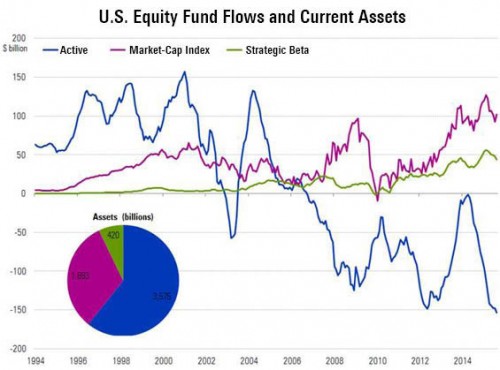

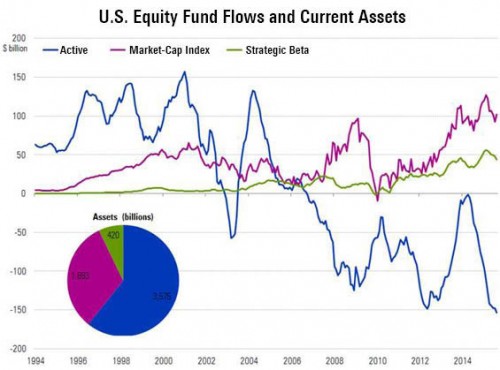

The outlook also remains uncertain and will ultimately be determined by market movements and asset flows. We’re neither smart enough nor dumb enough to predict future market movements and will defer that to the experts. As for asset flows, fee-richer active funds are losing ground to indexes and alternative products despite typically outperforming more passive strategies during market downturns. Overall, asset flows to riskier products (active or passive) are unlikely to improve until the recent volatility declines to more normal levels.

[caption id="attachment_9360" align="aligncenter" width="500"]

Source: Morningstar[/caption]

Q3 was an especially bad quarter for asset managers, with the group losing over $40 billion in market capitalization during a six week skid. Given the sector’s run since the last financial crisis, many suggest this was overdue and only pulls RIA valuation levels closer to their historic norms. The multiple contraction reflects lower AUM balances and the anticipation of reduced fees on a more modest asset base.

Q3 was an especially bad quarter for asset managers, with the group losing over $40 billion in market capitalization during a six week skid. Given the sector’s run since the last financial crisis, many suggest this was overdue and only pulls RIA valuation levels closer to their historic norms. The multiple contraction reflects lower AUM balances and the anticipation of reduced fees on a more modest asset base.

The most recent sell-off brings the industry to the brink of a bear market despite the S&P being down only 10% or so over the last few months. Such underperformance is not surprising for a business tethered to market conditions and investor sentiment. The market is acknowledging that revenue for equity managers is directly tied to index movements and earnings often vary more than management fees due to the presence of fixed costs (as demonstrated in the example below). Combining these dynamics with some multiple contraction reveals the market’s rationale for discounting these businesses in recent weeks.

The most recent sell-off brings the industry to the brink of a bear market despite the S&P being down only 10% or so over the last few months. Such underperformance is not surprising for a business tethered to market conditions and investor sentiment. The market is acknowledging that revenue for equity managers is directly tied to index movements and earnings often vary more than management fees due to the presence of fixed costs (as demonstrated in the example below). Combining these dynamics with some multiple contraction reveals the market’s rationale for discounting these businesses in recent weeks.

The impact on sector M&A is more nuanced. On the one hand, the lower price tag might entice prospective buyers fearful of overpaying. Yet for others the market’s recent variability could spook potential investors, and sellers may be less inclined to part with their businesses at a lower valuation. Though the third quarter figures aren’t out yet, the recent slide could curtail the deal making momentum we’ve witnessed over the last year-and-a-half.

The impact on sector M&A is more nuanced. On the one hand, the lower price tag might entice prospective buyers fearful of overpaying. Yet for others the market’s recent variability could spook potential investors, and sellers may be less inclined to part with their businesses at a lower valuation. Though the third quarter figures aren’t out yet, the recent slide could curtail the deal making momentum we’ve witnessed over the last year-and-a-half.

The outlook also remains uncertain and will ultimately be determined by market movements and asset flows. We’re neither smart enough nor dumb enough to predict future market movements and will defer that to the experts. As for asset flows, fee-richer active funds are losing ground to indexes and alternative products despite typically outperforming more passive strategies during market downturns. Overall, asset flows to riskier products (active or passive) are unlikely to improve until the recent volatility declines to more normal levels.

[caption id="attachment_9360" align="aligncenter" width="500"]

The outlook also remains uncertain and will ultimately be determined by market movements and asset flows. We’re neither smart enough nor dumb enough to predict future market movements and will defer that to the experts. As for asset flows, fee-richer active funds are losing ground to indexes and alternative products despite typically outperforming more passive strategies during market downturns. Overall, asset flows to riskier products (active or passive) are unlikely to improve until the recent volatility declines to more normal levels.

[caption id="attachment_9360" align="aligncenter" width="500"] Source: Morningstar[/caption]

Source: Morningstar[/caption]