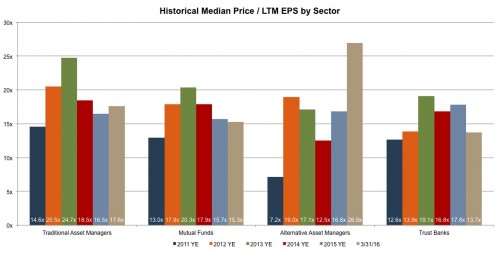

From a valuation perspective, it appears that alternative asset managers fared the best in Q1. The group’s median multiple rose 60% in the first three months of the year, besting all other classes of asset managers over the same period.

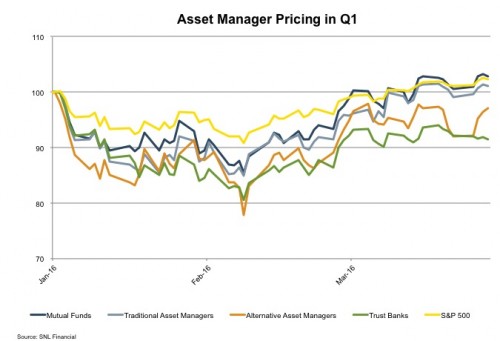

Closer inspection reveals a much bleaker quarter for the publicly traded hedge funds and private equity firms in our alternative asset manager index. Despite significant gains in the back half of the quarter, the group lost roughly 5% of its market cap during the first three months of the year. In other words, the E is falling faster than the P/E is rising for most of these businesses. With many names trading at a 40%+ discount to their 52 week high, the market seems to be questioning the long-term viability of many hedge funds and PE firms whose high fees and subpar performance have come under scrutiny in recent years.

Closer inspection reveals a much bleaker quarter for the publicly traded hedge funds and private equity firms in our alternative asset manager index. Despite significant gains in the back half of the quarter, the group lost roughly 5% of its market cap during the first three months of the year. In other words, the E is falling faster than the P/E is rising for most of these businesses. With many names trading at a 40%+ discount to their 52 week high, the market seems to be questioning the long-term viability of many hedge funds and PE firms whose high fees and subpar performance have come under scrutiny in recent years.

On the other end of the spectrum, more traditional, long-only managers appear to have taken some market share from their alternative counterparts over the same period. Investors continue to grow wary of higher fees, especially when performance suffers, so this is no surprise to those who follow the sector. Still, hedge funds are typically better poised to profit from market volatility, which might explain the group’s advancement since its mid-February bottom.

On the other end of the spectrum, more traditional, long-only managers appear to have taken some market share from their alternative counterparts over the same period. Investors continue to grow wary of higher fees, especially when performance suffers, so this is no surprise to those who follow the sector. Still, hedge funds are typically better poised to profit from market volatility, which might explain the group’s advancement since its mid-February bottom.

Moving forward, this disparity is unlikely to persist if many of these publicly traded alt managers are to remain a going concern. The past few weeks have been promising, but the index as a whole lost roughly half of its market cap from July of last year to February of 2016. An opportunistic investor with a high risk tolerance might see this as a buying opportunity. Others will look skeptically at the sector’s prospects in the era of passive investing.

Moving forward, this disparity is unlikely to persist if many of these publicly traded alt managers are to remain a going concern. The past few weeks have been promising, but the index as a whole lost roughly half of its market cap from July of last year to February of 2016. An opportunistic investor with a high risk tolerance might see this as a buying opportunity. Others will look skeptically at the sector’s prospects in the era of passive investing.