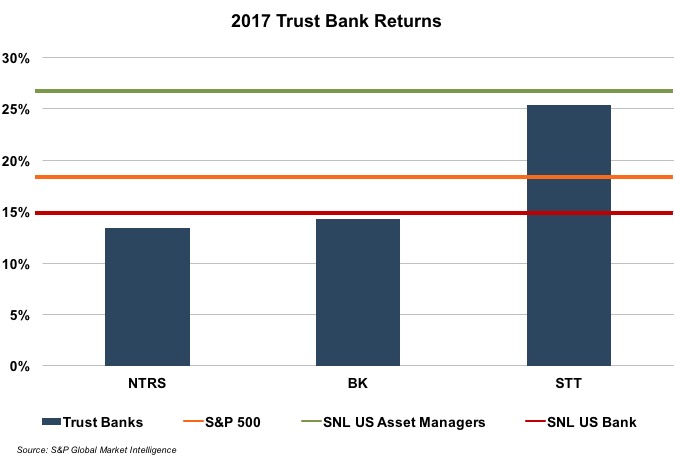

All three publicly traded trust banks (BNY Mellon, State Street, and Northern Trust) underperformed other categories of asset managers during 2017, and only State Street outperformed the S&P 500. While all three benefited from growth in Assets Under Custody and Administration (AUCA) and Assets Under Management (AUM) due to strong equity markets in 2017, the trust banks performed more in line with U.S. banks generally during 2017. The exception is State Street, which performed comparably to the SNL Asset Manager Index due in part to its large ETF business (State Street is one of the three largest ETF providers globally). The other two trust banks have less significant ETF business (Northern Trust) or none at all (BNY Mellon). Due in part to its strong ETF inflows, State Street is on track to pass BNY Mellon as the largest trust bank in terms of AUCA.

Throughout 2017, trust banks tended to underperform other classes of asset managers like alternative asset managers, mutual funds, and traditional asset managers. To put this in historical context, trust banks have lagged the broader indices since the financial crisis of 2008 and 2009, although in 2016 our trust bank index was the highest performing category of asset manager. With the exception of trust banks, all classes of asset managers outperformed the S&P 500, as rising equity markets and operating leverage combined to increase the profitability of these businesses.

Throughout 2017, trust banks tended to underperform other classes of asset managers like alternative asset managers, mutual funds, and traditional asset managers. To put this in historical context, trust banks have lagged the broader indices since the financial crisis of 2008 and 2009, although in 2016 our trust bank index was the highest performing category of asset manager. With the exception of trust banks, all classes of asset managers outperformed the S&P 500, as rising equity markets and operating leverage combined to increase the profitability of these businesses.

Despite the relative underperformance during 2017, trust banks saw increases in their two largest sources of fee revenue (servicing and investment management fees) due primarily to strengthening equity markets. Trust banks also saw improved net interest margins due to higher U.S. market interest rates. Trading services revenues, which are a less significant component of fee revenue than servicing and management fees, were generally down in 2017 due to low volatility in the equity markets. Trust bank trailing multiples have expanded in line with other categories of asset managers since last year, so their underperformance suggests that earnings haven’t kept pace.

Despite the relative underperformance during 2017, trust banks saw increases in their two largest sources of fee revenue (servicing and investment management fees) due primarily to strengthening equity markets. Trust banks also saw improved net interest margins due to higher U.S. market interest rates. Trading services revenues, which are a less significant component of fee revenue than servicing and management fees, were generally down in 2017 due to low volatility in the equity markets. Trust bank trailing multiples have expanded in line with other categories of asset managers since last year, so their underperformance suggests that earnings haven’t kept pace.

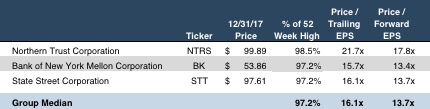

So have these securities gone from overbought to oversold? A quick glance at year end pricing shows the group valued at 14-16x (forward and trailing) earnings with the rest of the market closer to 25x, so that alone would suggest that they aren’t too aggressively priced. Still, the three companies are all trading near 52 week highs, so it’s hard to say they’re really all that cheap either.

So have these securities gone from overbought to oversold? A quick glance at year end pricing shows the group valued at 14-16x (forward and trailing) earnings with the rest of the market closer to 25x, so that alone would suggest that they aren’t too aggressively priced. Still, the three companies are all trading near 52 week highs, so it’s hard to say they’re really all that cheap either.

Mercer Capital's RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.