Industry Overview and History

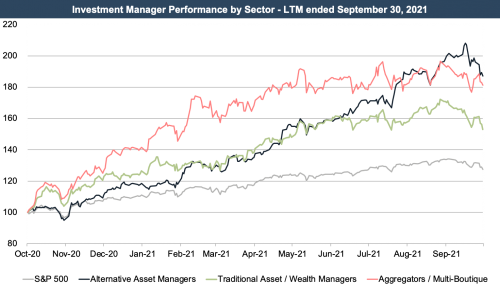

Over the last year, alternative asset managers have bested the market and most other categories of investment management firms by a considerable margin. Favorable market conditions, heightened volatility, strong investment returns, and growing interest from institutional investors are the primary drivers behind the sector’s recent rally. Our alt manager index actually doubled from October of 2020 to August of this year before giving back some of these gains during the market downturn last month.

Before this uptick, many alternative asset managers had struggled over the last several years. Asset outflows, the rising popularity of passive products, fee pressure, and underperformance relative to broader market returns had caused many hedge funds and PE firms to lag other investment management sectors. Industry valuations appear to have bottomed out with the market collapse during the first quarter of last year and have since rebounded. Growing investor appetite for risky assets with purported diversification benefits has fueled a fairly substantial turnaround for the sector over the last eighteen months or so. Current pricing is close to the 52-week high, and forward multiples are noticeably lower than LTM multiples, suggesting peaked valuations and expected earnings increases over the next twelve months.

While hedge funds have underperformed since the Financial Crisis (the S&P 500 index has dwarfed the performance of hedge funds as measured by the HFRI Fund Weighted Composite Index since 2009), recent volatility has improved their performance on a relative basis. Hedge fund capital typically lags its underlying fund performance, so the market seems to be anticipating that higher inflows in the coming months as investors reallocate their portfolios in light of recent performance.

Alternative assets often serve to either increase diversification or enhance portfolio returns. In a near zero interest rate environment, institutional investors have sought return-generating assets. Over the last couple of years, pension funds have started diversifying their portfolios to include alternative investments in order to chase higher risk, higher return assets. It is more difficult for the average investor to gain exposure to alternative assets due to significant minimum investment requirements. While some efforts have been made to expand distribution to the retail market, institutional investors are still the primary target market for alternative managers.

Before this uptick, many alternative asset managers had struggled over the last several years. Asset outflows, the rising popularity of passive products, fee pressure, and underperformance relative to broader market returns had caused many hedge funds and PE firms to lag other investment management sectors. Industry valuations appear to have bottomed out with the market collapse during the first quarter of last year and have since rebounded. Growing investor appetite for risky assets with purported diversification benefits has fueled a fairly substantial turnaround for the sector over the last eighteen months or so. Current pricing is close to the 52-week high, and forward multiples are noticeably lower than LTM multiples, suggesting peaked valuations and expected earnings increases over the next twelve months.

While hedge funds have underperformed since the Financial Crisis (the S&P 500 index has dwarfed the performance of hedge funds as measured by the HFRI Fund Weighted Composite Index since 2009), recent volatility has improved their performance on a relative basis. Hedge fund capital typically lags its underlying fund performance, so the market seems to be anticipating that higher inflows in the coming months as investors reallocate their portfolios in light of recent performance.

Alternative assets often serve to either increase diversification or enhance portfolio returns. In a near zero interest rate environment, institutional investors have sought return-generating assets. Over the last couple of years, pension funds have started diversifying their portfolios to include alternative investments in order to chase higher risk, higher return assets. It is more difficult for the average investor to gain exposure to alternative assets due to significant minimum investment requirements. While some efforts have been made to expand distribution to the retail market, institutional investors are still the primary target market for alternative managers.

Over the last couple of years, pension funds have started diversifying their portfolios to include alternative investments in order to chase higher risk, higher return assets.

Over the last several years, alternative asset managers have been largely successful at securing a spot in institutional investors’ portfolios. In terms of diversification, investors have started positioning themselves for longer term volatility due to the pandemic and a slowing IPO market. While investor interest in uncorrelated asset classes such as alternatives fell during the longest bull market run in history (2009-20), recent volatility has pushed investors back to the asset class.

Franklin Resources’s (ticker: BEN) recently announced purchase of private equity firm Lexington Partners for $1.75 billion is illustrative of growing interest from more traditional asset managers in the alt space.

Practice Management

Today, the main priority for most alternative asset managers is raising assets. Assets follow performance and fee reduction, especially in the alternatives space, are the most consequential ways to attract fund flow. After a decade of lackluster performance, alternative managers have had no choice but to look to price reduction to bring in new assets. Amidst fee pressure, alterative managers are deviating from the typical “2 and 20” model.

While traditional asset managers have been able to reduce fees by achieving some measure of scale, alternative managers must be careful to not sacrifice specialization. Alternative managers have seen some success utilizing technology in the front office or outsourcing certain functions in order to reduce overhead and spare time for management to focus on asset raising.

Summary

Despite improving performance over the last year or so, the alt asset sector continues to face many headwinds, including fee pressure and expanding index opportunities. While the idea of passively managed alternative asset products seems like an oxymoron, a number of funds exist with the goal of imitating private equity returns. Innovative products are being introduced to the investing public every day. And while there is currently no passive substitute to alternatives, we do believe that the industry will continue to be influenced by many of the same pressures that traditional asset managers are facing today, despite the recent uptick in alt manager valuations.