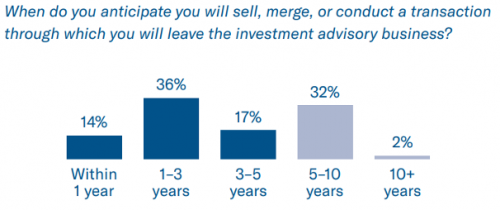

According to a recent Franklin Templeton Survey, only 14% of RIA principals expect to transact their ownership-interest in their investment management firm over the next year while 36% expect to sell between one and three years from now.

Source: Franklin Templeton Investments

These statistics are perplexing for an aging industry where less than half of advisors over the age of 65 have a formal succession plan and acquisition multiples continue to climb higher.

Source:Franklin Templeton Investments

There are some explanations to this disconnect. From an economic perspective, many RIA principals are hesitant to forego their high dividend coupon in a yield-starved environment. Additionally, when an RIA principal exits the business, they forfeit their salary and bonus payments, so the sale price would have to justify this substantial loss of annual income. Many principals also prefer to keep their firm employee owned, but it’s often difficult to sell the business to younger staff members who may be unwilling or unable to purchase the firm at its current market value. Additionally, the sale of smaller advisory practices (under $100 million in AUM) may not be practical since the primary principal often manages most of the client relationships, which may not transfer after he or she exits the business.

These realities don’t excuse the industry’s ownership from failing to plan for an eventual sale or exit from the business. Most investment management firms have value beyond their founding principals. Not only can planning for that eventuality maximize your sale proceeds, but it can also ensure your key employees and clients will stick around long after your departure.

How To Ensure a Successful Succession

A logical starting point for accomplishing a successful transaction is tying management succession to ownership succession. Many of our clients’ principals sell a portion of their ownership to junior partners every year (or two) at fair market value (FMV). This process ensures that selling shareholders (who hope to sell at a maximum value) are incentivized to continue operating the business at peak levels while allowing rising partners to accrue ownership over time. Many buy-sell agreements also call for departing partners to sell their shares at a discount to FMV if they are terminated or leave within a pre-specified period to ensure they remain committed after the initial buy-in.

Simply put, a successful succession requires the alignment of buyer and seller interests. Gradually transitioning ownership to the next generation of management at a reasonable price is one way to align your interests with the next generation of management.

A successful succession plan also requires decoupling your day-to-day responsibilities from ownership. This can’t (and shouldn’t) happen overnight. After you’ve identified a capable successor(s), make sure he or she assumes more of your management responsibilities and not just your share count. Your work hours should decrease over this transition period.

When advising clients on management and ownership succession, we often tell principals that are approaching retirement to ask themselves where they want to be in five or ten years (depending on their age and other factors) and work towards that goal. We rarely hear that they want to maintain their current work levels for the rest of their career. Have a goal in mind and steadily work towards it as others assume your responsibilities and ownership. It should pay off in retirement.